Lithium Iron Phosphate (LiFePO4) Energy Storage Systems

Feb 9, 2025 · Falling lithium iron phosphate (LiFePO4) battery prices serve as a dominant driver for commercial and industrial energy storage adoption. Average cell-level costs for LiFePO4

Lithium Iron Phosphate Price Trend and Chart 2025

Nov 21, 2023 · The report offers a holistic view of the global lithium iron phosphate pricing trends in the form of lithium iron phosphate price charts, reflecting the worldwide interplay of supply

Lithium Iron Phosphate Prices, Chart, Index and Regional Data

Nov 30, 2024 · In December 2023, the price of lithium iron phosphate in China climbed to $8,239 per metric ton, reflecting significant market dynamics and demand trends. This increase can

Fe-based phosphate nanostructures for supercapacitors

Feb 1, 2021 · Fe-based electrode materials mainly include iron oxide [21, 22], ferric oxide [23, 24], hydroxy iron oxide [25, 26], ferric nitrate [27, 28] and ferric chloride [29]. Phosphate-based

"Lithium iron phosphate battery supercapacitor" new hybrid

Jun 27, 2025 · Broaden the application scenarios Drive the high-quality development of the supercapacitor industry chain "As an electrochemical energy storage device, supercapacitors

Facile synthesis of a carbon supported lithium iron phosphate

Oct 15, 2024 · Abstract Lithium iron phosphate (LiFePO 4, LFP) has become one of the most widely used cathode materials for lithium-ion batteries. The inferior lithium-ion diffusion rate of

Preparation of carbon-coated lithium iron phosphate/titanium nitride

Oct 29, 2014 · The carbon-coated lithium iron phosphate (C-LiFePO4) supporting on the titanium nitride (TiN) substrate was designed as the electrode material of lithium-ion supercapacitor for

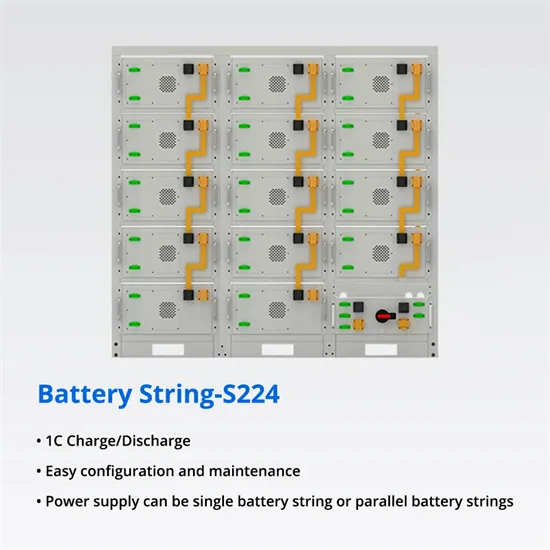

215kwh 372kwh Industrial Energy Storage System Lithium Iron Phosphate

Aug 18, 2024 · 215kwh 372kwh Industrial Energy Storage System Lithium Iron Phosphate Battery Lithium Titanate Battery and Supercapacitor Independent or Mixed Design, Find Details and

The thermal-gas coupling mechanism of lithium iron phosphate

Jan 1, 2025 · Abstract Lithium iron phosphate batteries, renowned for their safety, low cost, and long lifespan, are widely used in large energy storage stations. However, recent studies

Rising Prices in the Lithium Iron Phosphate (LFP) Battery

Apr 8, 2025 · The lithium iron phosphate (LFP) battery market has experienced significant price hikes in 2025, influenced by various factors, including production difficulties and escalating raw

6 FAQs about [Supercapacitor and lithium iron phosphate prices]

Why are lithium iron phosphate batteries so expensive?

According to IEA’s latest report, the price of Lithium Iron Phosphate (LFP) batteries was heavily impacted by the surge in battery mineral prices over the past two years, primarily due to the increased cost of lithium, its critical mineral component.

How much does a lithium carbonate battery cost?

Similarly, the price for lithium carbonate has fallen from a high of approximately $70,000 per metric ton to well below $15,000 in 2024. This article focuses primarily on two of the most sought-after Li-ion battery cathode chemistries in the automotive industry today — NCM811 and lithium iron phosphate (LFP) batteries.

Which lithium ion battery cathode chemistries are most popular?

This article focuses primarily on two of the most sought-after Li-ion battery cathode chemistries in the automotive industry today — NCM811 and lithium iron phosphate (LFP) batteries. Staying ahead of these automotive industry trends are crucial for manufacturers and suppliers as they navigate the evolving landscape of EV battery costs.

How much does LFP battery cost a tonne?

Since mid-2020, the discount mostly hovered around 5,500-6,500 yuan per tonne, before hitting a low of 2,000 yuan per tonne in mid-February, according to Fastmarkets’ data. “The elevated technical-grade lithium carbonate [price] underlines the stockpiling drives among consumers who are anticipating increased demand for LFP batteries.

Are LFP batteries more expensive than NMC batteries?

Despite the price growth of lithium outpacing other minerals, LFP batteries remain more affordable compared to Nickel Manganese Cobalt (NMC) batteries. In 2023, the price difference narrowed, with NMC batteries being less than 25% more expensive than their LFP counterparts, down from a 50% premium in 2021.

Why is battery-grade lithium carbonate trading at a premium above hydroxide?

Additionally, the slower pace of adoption of nickel-rich NCM batteries among OEMs has resulted in battery-grade lithium carbonate trading at a premium above hydroxide in China since early December last year – as opposed to the discount seen in the previous two to three years.

Random Links

- Outdoor power supply is the cheapest

- Communication base station lithium battery supplier

- Abuja grid-side energy storage operation model

- Photovoltaic module thin film brand

- China 3 5 kva hybrid inverter in Turkey

- Modular Uninterruptible Power Supply

- Guinea-Bissau 199kw inverter manufacturer

- How many solar panels are there in 10 kilowatts

- Inverter 6000w high power 48v

- Wholesale al hamad switchgear in Vancouver

- Best China hybrid inverter on grid Price

- Electric energy storage cabinet installation

- 20v tool battery over discharge protection

- Argentina 2mwh energy storage container

- Wholesale solar power supply in Russia

- Porto Novo Industrial Energy Storage Cabinet Manufacturer

- Photovoltaic battery cabinet effect base station

- Battery connected to inverter or outdoor power supply

- The load-bearing capacity of the battery room of the communication base station

- Energy storage photovoltaic panel manufacturer in Barcelona Spain

- Wholesale afriipower inverter in Costa-Rica

- 5kw solar system with battery in Germany

- Photovoltaic panel color difference

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.