Energy Storage Industry Trends: C&I Energy Storage Market

Feb 6, 2025 · With the transformation of the global energy structure and the rapid development of renewable energy, the commercial and industrial energy storage (C&I ESS) market will see

Unlocking Insights for Commercial and Industrial Energy Storage

Mar 16, 2025 · The Commercial and Industrial (C&I) Energy Storage Systems market is experiencing robust growth, driven by increasing electricity costs, the intermittent nature of

Exporters of Energy Storage Solutions for Industrial and Commercial

With more businesses recognizing the importance of energy efficiency and reliability, industrial and commercial energy storage solutions have become critical. This transformation is not only

Commercial & Industrial Solar & Battery Energy Storage

Apr 25, 2024 · With the rapid advancements in clean energy technologies and evolving market dynamics, embracing solar photovoltaic (PV) and energy storage solutions will be key to

Commercial and Industrial Energy Storage: Key to the Global Energy

Feb 6, 2025 · Discover how commercial and industrial energy storage is driving the global energy transition. Learn about key applications, market trends, policy incentives, and technological

Exhibition Review | The 2025 Myanmar Photovoltaic Energy Storage

Feb 21, 2025 · The household energy storage lithium battery packs and industrial and commercial energy storage systems exhibited this time have been widely used and received numerous

Anticipating Global Surge: Household Energy Storage Gains

Feb 4, 2024 · According to TrendForce statistics, the projected global installed capacity increment in 2024 is as follows: large-sized energy storage takes the lead with 53GW/130GWh, followed

6 FAQs about [Industrial and commercial energy storage exports]

Will commercial and industrial energy storage systems become more profitable by 2030?

According to the latest research, by 2030 it will be much more straightforward for commercial and industrial energy storage systems to participate in spot markets and provide ancillary services, leading to substantial revenue growth.

What is the future of energy storage in China?

In China, generation-side and grid-side energy storage dominate, making up 97% of newly deployed energy storage capacity in 2023. 2023 was a breakthrough year for industrial and commercial energy storage in China. Projections show significant growth for the future.

Why is industrial energy storage important?

Industrial energy storage systems, offering benefits such as enhanced power reliability, are crucial for bridging self-developed solar power facilities with the public grid, and require effective and secure integrated solutions.

How HBIS is transforming the steel industry?

With a low-carbon development roadmap, HBIS continues to optimize its energy structure, advance energy storage technologies, and promote "new energy + storage" projects, paving the way for the green transformation of the steel industry. Chen Haisheng, Chairman, China Energy Storage Alliance

What challenges do industrial companies face when deploying energy storage systems?

On the other hand, industrial companies are confronted with high costs of the procurement and deployment of energy storage systems, such as land acquisition, grid connection and financing. The World Economic Forum has brought together three perspectives on advancing energy storage deployment in the industrial sector.

What is China's energy storage strategy?

In China, generation-side and grid-side energy storage dominate, making up 97% of newly deployed energy storage capacity in 2023. In China, generation-side and grid-side energy storage dominate, making up 97% of newly deployed energy storage capacity in 2023. 2023 was a breakthrough year for industrial and commercial energy storage in China.

Random Links

- Wellington UPS

- Athens Large Energy Storage Power Wholesale

- Solar battery storage factory in Dominican-Republic

- Manila Energy Storage Cabinet Container Customization Manufacturer

- Specific components of new energy storage cabinet

- Circuit breaker in substation in Canberra

- Beiya PV Inverter Specifications

- Products with voltage source inverter

- Price of micro-light glass photovoltaic panels

- 1000kwh energy storage system in Uzbekistan

- All-vanadium liquid flow battery project

- Working process of base station power supply system

- Home photovoltaic energy storage products

- Price of 20kw photovoltaic panel

- Latest Acceptance Standards for Energy Storage Cabinets in Chisinau

- Convenient energy storage battery manufacturer

- Berlin Photovoltaic Panel Manufacturer

- South Sudan develops energy storage battery manufacturers

- 60v inverter power

- How to store video footage using solar energy on-site

- Do communication base stations consume a lot of power

- Price of mobile energy storage power supply in Indonesia

- Charging pile energy storage battery price

Residential Solar Storage & Inverter Market Growth

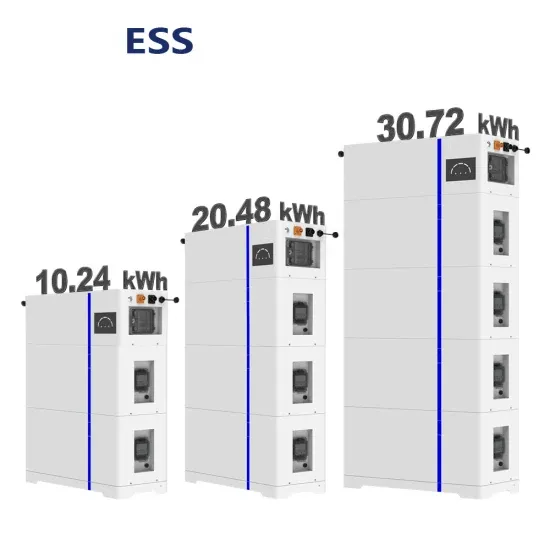

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.