Intel debuts 5G base station chips as alternative to Huawei

Feb 26, 2020 · US chip giant Intel has entered the 5G base station chip race with bold ambitions to be the market leader by 2021 in a bid to help telecom equipment maker Ericsson and other

China Telecom Builds First 5G Micro Base Station Using Only

Feb 6, 2023 · (Yicai Global) Feb. 3 -- Chinese mobile network operator China Telecom''s research arm has developed its own fifth-generation low-power micro base station, that boosts indoor

6 FAQs about [Global communication equipment manufacturers 5g base station chips]

What are 5G base station chips?

5G Base Station Chips are specialized semiconductor components designed to power the hardware of 5G base stations. These chips handle tasks such as signal processing, data transmission, and network management, enabling high-speed, low-latency communication in 5G networks.

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

Why are 5G base station chips so expensive?

Designing and manufacturing advanced 5G base station chips involves significant R&D and production costs. This financial burden can hinder the entry of smaller players and limit market expansion.

What are the top 5G chipset companies?

Some of the company's offerings include: By the IMARC Group, the top 5G chipset companies are Broadcom, Huawei Technologies, Infineon Technologies, Intel Corporation, Mediatek, Nokia, Qorvo, Qualcomm Technologies, Samsung Electronics, and Advanced Micro Devices.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is the global 5G chipset market size?

The global 5G chipset market size reached US$ 6.0 B illion in 2023. As per the analysis by IMARC Group, the top manufacturers in the 5G chipset industry are focusing on launching cost-effective software-defined network and network function virtualization to expand their product portfolio and gain a competitive edge in the market.

Random Links

- Huawei Algeria Energy Storage Sales

- 220v2 kW outdoor power supply

- Seoul Outdoor Power Supply BESS

- Photovoltaic panel battery support

- Burundi Solar Inverter Manufacturer

- Outdoor site of photovoltaic power generation system of communication base station

- Prices of Porto Novo energy storage containers

- Classic solar lights for home use

- Dc breaker for solar in China in Lithuania

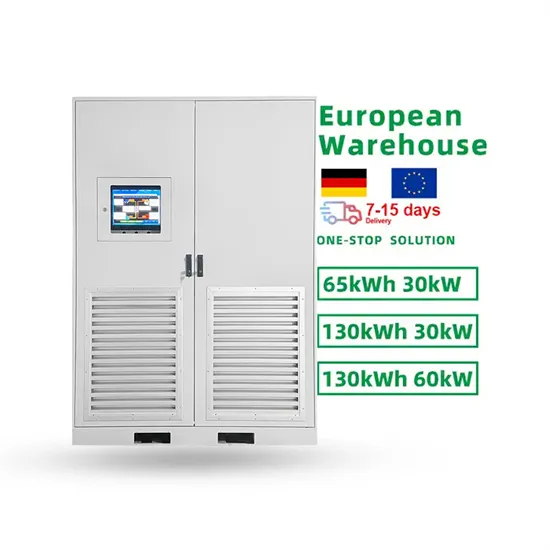

- Ventilation device inside the battery cabinet

- Replacing photovoltaic glass with broken glass

- How much is the Pretoria water pump inverter price

- Energy storage power supply production and processing

- High quality 3 2 kva inverter in Mozambique

- Energy storage cabinet project investment and franchise

- San Jose Solar Power Generation Electricity System

- Myanmar Mobile Container Wholesale

- Solar lighting system supporting solutions

- Huawei energy storage device battery module

- Technical Specifications for Energy Storage Assembly of Communication Base Stations

- How much does it cost to install photovoltaic panels in Accra

- Somalia 20kw energy storage solution

- Safety management of grid-side energy storage

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.