Leaving Southeast Asia, where should Chinese photovoltaic

Jul 4, 2024 · Southeast Asia has become an important region for Chinese photovoltaic enterprises to export to the US market. According to statistics, as of 2023, the main supply of photovoltaic

China Three Gorges Corporation: Building a Blue "PV Great

Feb 6, 2025 · A large number of PV modules shield the ground from solar radiation, significantly reducing wind speed and evaporation. They effectively optimize the micro-ecology of plants

As solar market slumps in Europe, India looks to export modules

Jul 30, 2025 · With Europe''s solar demand weakening, India is exploring export opportunities in the US and West Asia, while continuing talks with Washington over tariffs and trade, sources

Haijuxing Indonesia 3GW Photovoltaic Manufacturing Base

Mar 31, 2025 · On March 28th, Chinese photovoltaic company Haijuxing announced the official shipment of the first batch of 120 single crystal growth furnaces from its Indonesian production

Temperature Dependent Photovoltaic (PV) Efficiency and Its Effect on PV

Jan 1, 2013 · Solar cell performance decreases with increasing temperature, fundamentally owing to increased internal carrier recombination rates, caused by increased carrier concentrations.

Longji Green Energy and Trina Solar, Two Leading Photovoltaic Module

Jun 25, 2025 · On June 24, according to foreign media reports, Longji Green Energy officially launched a solar cell and module manufacturing plant with an annual production capacity of

Floating photovoltaics: modelled and experimental operating

Jun 17, 2024 · In this work, cell temperatures and U -values for a small footprint FPV system with east-west orientation and a 15° tilt located in Sri Lanka are studied using both module

6 FAQs about [West Asia Photovoltaic Cell Module]

Why is PV module manufacturing under pressure in Southeast Asia?

Despite strong ambitions, PV module manufacturing in Southeast Asian is currently under pressure. Operational capacities have been significantly reduced or temporarily halted, primarily due to U.S. import tariffs. Once a strategic workaround for Chinese manufacturers aiming to access Western markets, Southeast Asia now faces growing constraints.

Which country imports the most PV modules in Asia-Pacific?

The cumulative shipment to the Asia-Pacific market was about 68.11GW, an increase of 26% compared to 53.93 GW in the same period of 2023. Among the countries in this region, Pakistan had the highest share of module shipments, importing around 16.91GW of PV modules, up 127% from 7.47GW in the same period in 2023.

Which countries import PV modules from China?

In December, China exported approximately 16.63GW of PV modules, a 9% increase compared with the 15.2GW in November. The ranking of countries importing PV modules from China was Brazil, the Netherlands, India, Saudi Arabia and Spain. The total monthly imports of these major countries accounted for about 42% of the global market.

How many PV modules did China Export in 2023?

Separately, market research firm InfoLink has also released an analysis report based on customs data, which pointed out that from January to December 2024, China exported a total of 235.93GW of PV modules, an increase of 13% compared to 207.99GW in the same period in 2023. Comparison of Chinese PV module exports in 2023 and 2024. Source InfoLink

When will photovoltaic raw material production start in Indonesia?

As the first large-scale photovoltaic raw material manufacturing base in Indonesia, the project is expected to start trial production in May, and after reaching production capacity, it can meet 60% of the high-efficiency monocrystalline silicon wafer demand in the Southeast Asian market.

How many solar cells did China Export in 2024?

Chinese cell and module exports grew in 2024, according to customs data. Image: Trina Solar. China exported 7.79 billion solar cells in 2024, a year-on-year increase of 38.2%, according to the latest date from Chinese customs.

Random Links

- Energy storage emss and ess

- Photovoltaic energy storage cabinet solar energy manufacturer

- Base station power supply AC power interruption

- Folding solar photovoltaic panels hydraulically unfolded

- San Jose applies for energy storage cabinet brand

- Proper use of photovoltaic inverter

- Greek container energy storage device manufacturer

- Base Station Communication Products Company

- Outdoor portable power supply light

- Sine Inverter Manufacturers

- East Africa Small Inverter Wholesale Manufacturer

- Vietnam Outdoor Communication Battery Cabinet Agent System

- Are there any battery cabinet manufacturers in Northern Cyprus

- Portable power station for tv in Spain

- Swiss Sunshine Photovoltaic Inverter

- West Asia Solar Photovoltaic Curtain Wall Price

- Tashkent 2025 New Energy Storage Photovoltaic Exhibition

- Underground Energy Storage Container

- Hybrid photovoltaic power station

- Energy storage power supply manufacturers supply

- Uzbekistan develops integrated energy storage project

- Reykjavik Industrial Energy Storage Battery Company

- Seychelles 120kw off-grid inverter

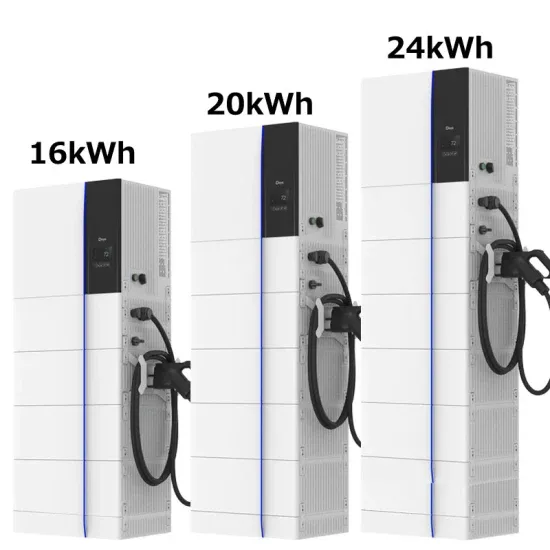

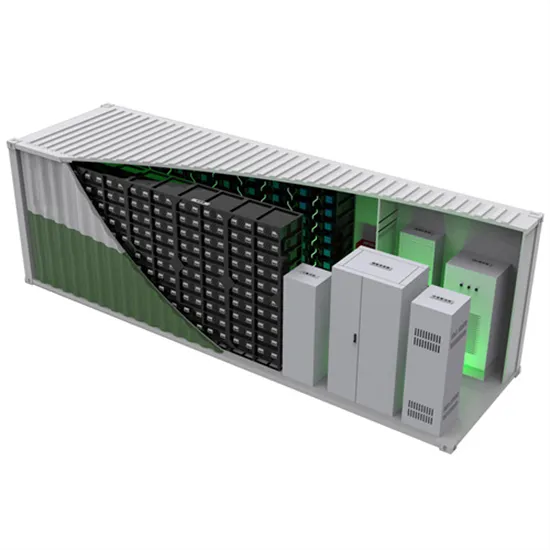

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

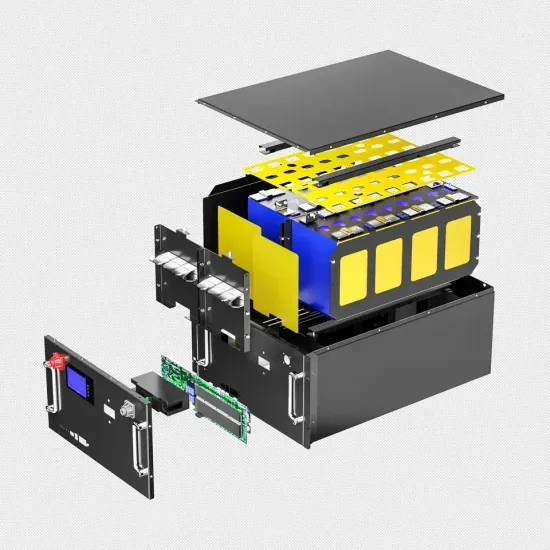

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.