Environmental impact: the challenge for base station roll-out

Apr 1, 2013 · Mobile operators carry signals to a handset through the airwaves via a network of base station sites, full of antennas and equipment. Next-generation mobile networks will

How Solar Energy Systems are Revolutionizing Communication Base

Nov 17, 2024 · Energy consumption is a big issue in the operation of communication base stations, especially in remote areas that are difficult to connect with the traditional power grid,

3.5 kW wind turbine for cellular base station: Radar cross

Oct 9, 2014 · Due to dramatic increase in power demand for future mobile networks (LTE/4G, 5G), hybrid- (solar-/wind-/fuel-) powered base station has become an effective solution to reduce

Self-sufficient cell towers; when will cell sites go off-grid en

Oct 4, 2022 · Schadock explains either 4, 8, or 16 turbines will be installed at each tower depending on the power requirements of the tower in question combined with wind quantity &

Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

What Is Base Station in Mobile Communication? – The Heart

Jan 11, 2025 · In the era of rapid technological advancements, mobile communication has become an integral part of our daily lives. With the increasing demand for high-speed data and

#7 Things to Know About Base Station Antennas of Mobile Communication

Oct 20, 2022 · The base station antenna is a crucial part of the mobile communication system, and many elements have gone into its creation. The evolution of the base station antenna will

6 FAQs about [How many kilowatts of wind power does a communication base station have ]

Can wind energy be used to power mobile phone base stations?

Worldwide thousands of base stations provide relaying mobile phone signals. Every off-grid base station has a diesel generator up to 4 kW to provide electricity for the electronic equipment involved. The presentation will give attention to the requirements on using windenergy as an energy source for powering mobile phone base stations.

How much energy does a base station use?

A typical 3-sector base station site holding hardware from several carriers could draw anywhere between 2.5 to 10kW, but would typically sit somewhere in the middle. MTN Consulting estimates operators spend around 5-6 percent of their operating expenses, excluding depreciation and amortization, on energy costs.

Why do off-grid telecommunication base stations need generators?

As the incessant demand for wireless communication grows, off-grid telecommunication base station sites continue to be introduced around the globe. In rural or remote areas, where power from the grid is unavailable or unreliable, these cell sites require generator sets to provide power security as prime power or backup standby power.

Can wind power a mobile network tower?

Initial tests showed that on windy days, more renewable energy could be generated than was consumed by site operations. In the UK, Vodafone has been working with Crossflow Energy for two years to use the latter’s wind turbine technology in combination with solar and battery technologies to create a self-powered mobile network tower.

How many turbines will be installed at each tower?

Schadock explains either 4, 8, or 16 turbines will be installed at each tower depending on the power requirements of the tower in question combined with wind quantity & speed. Each pair of turbine units has a nominal capacity of 1kW in winds of 3.5m/s or more; the units have an approximate energy output of 1,500kWh per year.

How much energy does a 5G base station consume?

But the analyst firm says a typical 5G base station consumes up to twice or more the power of a 4G base station; it notes that the industry consensus is that 5G will double to triple energy consumption for mobile operators, once networks scale.

Random Links

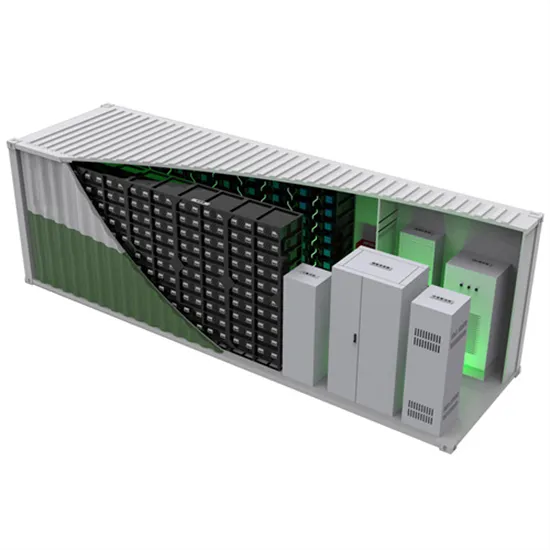

- Mali Industrial Energy Storage System

- Outdoor Energy Storage Mobile Power Solar

- How big of an uninterruptible power supply is needed for 60kw

- Energy storage container battery cabinet

- Asian energy storage battery custom manufacturer

- Can solar lights be moved at home

- Outdoor energy storage glass

- Household energy storage system shipments

- How much does a supercapacitor cost in Democratic Republic of Congo

- Some parts of uninterruptible power supply UPS

- There are several types of energy storage cabinet batteries

- Photovoltaic inverter energy storage cabinet

- New energy storage battery in Almaty Kazakhstan

- Energy storage field on the power generation side

- Jbl208 outdoor power supply solution

- How much heat dissipation should a liquid-cooled energy storage cabinet produce

- Albania Steel Structure Energy Storage Project

- Personal energy storage power station

- Is antimony used in photovoltaic glass

- Layoun lithium battery energy storage battery

- Is the energy storage power supply an IT product

- Gfci circuit breaker for sale in Poland

- Communication 5g base station photovoltaic

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.