Grid-connected solar-powered cellular base-stations in Kuwait

Sep 1, 2023 · In turn, the number of base-stations (BSs) has increased rapidly for wider ubiquitous networking; however, powering BSs has become a major issue for wireless service providers.

Toward Net-Zero Base Stations with Integrated and Flexible Power Supply

Jan 20, 2022 · To finetune the power mismatch between power supply and demand in each virtual cell, we propose software-defined techniques to flexibly control the discharging/charging of a

Prospects of key technologies of integrated energy systems for rural

Feb 1, 2021 · Owing to increasing environmental concerns and resource scarcity, integrated energy system shave become widely used in communities. Rural energy systems, as one of

Optimum sizing and configuration of electrical system for

Jul 1, 2025 · Proposed a model for optimal sizing & resources dispatch for telecom base stations. The objective is to achieve 100% power availability while minimizing the cost. Results were

Energy performance of off-grid green cellular base stations

Aug 1, 2024 · The most energy-hungry parts of mobile networks are the base station sites, which consume around of their total energy. One of the approaches for relieving this energy pressure

Rural renewal: telcos and sustainable energy in Africa

Nov 11, 2024 · 1 The rural energy challenge 1.1 The strain on P&L The economics of rolling out networks in rural areas for the telecoms industry have long proved challenging. The difficulties

Optimal configuration for photovoltaic storage system

Oct 1, 2021 · In this study, the idle space of the base station''s energy storage is used to stabilize the photovoltaic output, and a photovoltaic storage system microgrid of a 5G base station is

4 FAQs about [Rural base station network power supply source]

What is the main source of power for a base station?

In the case of base stations situated in regions with bad-grid or off-grid power availability, the predominant source of power for the base stations is diesel generators. [4,6] Diesel generation is costly in both the procurement of fuel and travel required to maintain adequate fuel levels at the base stations.

Do mobile network operators want to power remote base stations?

It is shown that mobile network operators express significant interest for powering remote base stations using renewable energy sources. This is because a significant percentage of remote base station sites on the global level are still diesel powered due to lack of connections to the electricity grid.

How do base stations use energy?

Since base stations are major consumers of cellular networks energy with significant contribution to operational expenditures, powering base stations sites using the energy of wind, sun, fuel cells or a combination gain mobile operators’ attention.

What are the primary sources of power for a mobile base-station?

The primary sources of power for these mobile base-station vary by region and can generally be categorized into 3 buckets: Reliable grid power: AC mains or grid power can reliably serve as the primary power supply.

Random Links

- Grid-connected inverter 28335

- Paramaribo Wind Energy Storage Company

- Guatemala City 12v40a lithium battery pack continued discharge

- Photovoltaic panel output current

- 3000w solar inverter for sale in Namibia

- Belgian Tin Energy Storage Project

- High voltage 10 kW inverter

- Cuba Energy Storage Grid

- Best portable power station cheap exporter

- TCL Solar Photovoltaic Panels in Guatemala City

- Khartoum wind solar and storage integration

- Lithuania Large Energy Storage Project

- How long can a 72v inverter be used

- Energy storage container side wall embedded parts

- Laayoune BESS rooftop photovoltaic panels

- Barbados Energy Storage Integrated Equipment Manufacturer

- 5G base station power distribution capacity

- Nassau Photovoltaic Panel Wholesale

- Can I bring an outdoor power supply to Paramaribo

- How many manufacturers of Magadan energy storage batteries are there

- What companies are engaged in energy storage inverters

- Inverter grid-connected charging and discharging price

- Which is better high frequency inverter or amorphous

Residential Solar Storage & Inverter Market Growth

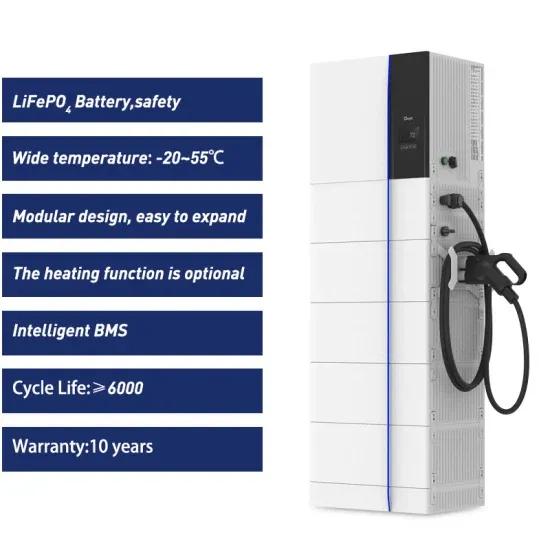

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.