National Survey Report of PV Power Applications in the

Jan 9, 2025 · The solar PV Dutch market is defined as the market of all nationally installed solar PV applications, both roof top and ground mounted systems. A solar PV application consists of

20 Top Solar Companies in Netherlands · August 2025 | F6S

Aug 1, 2025 · Detailed info and reviews on 20 top Solar companies and startups in Netherlands in 2025. Get the latest updates on their products, jobs, funding, investors, founders and more.

6 FAQs about [Photovoltaic panels solar power generation panels in the Netherlands]

How are solar panels used in the Netherlands?

Solar cell panels are used to convert this energy into electricity. The Netherlands solar energy market is segmented by technology and end-user. By end-user, the market is segmented into residential, industrial, and utility. By technology, the market is segmented into solar photovoltaic (PV) and concentrated solar power (CSP).

What is the solar PV Dutch market?

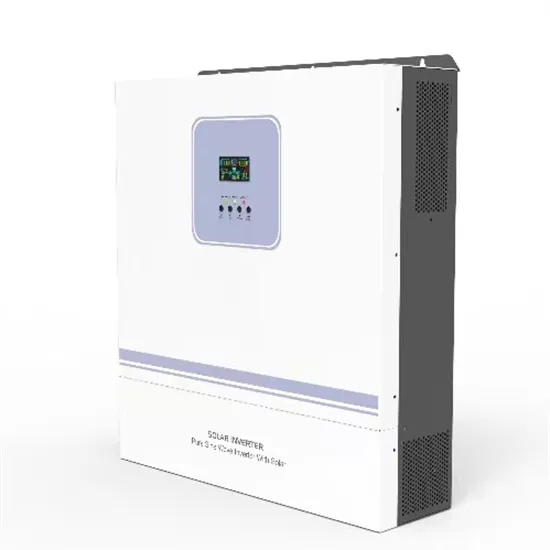

The solar PV Dutch market is defined as the market of all nationally installed solar PV applications, both roof top and ground mounted systems. A solar PV application consists of modules, a set up box, inverter, mounting system and all installation and electrical control components needed for its management.

Why should you invest in solar panels in the Netherlands?

The Netherlands offers a favorable environment for harnessing solar energy, both climatically and policy-wise. Financial benefits like subsidies and net metering make solar panel adoption economically attractive. Integrating solar panels with Dutch architectural styles enhances homes while promoting sustainability.

Why are solar panels becoming more popular in the Netherlands?

Growing environmental awareness, falling prices of solar panels and low interest rates ensure rapid growth. Together, these panels account for 7,000 MWpik. That is 5% of the total electricity production in the Netherlands. If all available space for PV panels in the Netherlands is used, the Netherlands can meet 75% of its energy needs.

What are the future prospects for solar PV in the Netherlands?

Cederik Engel, Managing Director of CCE The Netherlands and Head of ESG at CCE Holding, sees strong prospects ahead. The Netherlands leads the EU in per-capita solar PV capacity, having added around three gigawatts annually over the past three years.

How a 10 MW photovoltaic system can be built in the Netherlands?

Netherlands: Ampyr and Rockwool conclude solar PPA In order to build a 10 MW photovoltaic system, CCE The Netherlands invested around mid-three-digit amount euros in preparing the soil on 6.2 hectares and sealing the area. A special geotextile layer is used to seal the area for at least three decades and enables it to be used for other purposes.

Random Links

- Does photovoltaic equipment include inverters

- High quality power switchgear in Brisbane

- 62 photovoltaic panel specifications

- Energy storage ancillary products

- Huawei Russia St Petersburg Energy Storage Container

- Power Inverter for sale

- Royu circuit breaker in China in Bangkok

- Wind Power Portable Power Supply

- 25kw commercial inverter

- Huawei transparent outdoor power brand

- Energy storage and electric energy storage

- Belgium 5g base station power supply factory

- Freetown Lithium Battery Pack

- Energy storage lead-acid battery price

- Oslo High Frequency Sine Wave Inverter

- Photovoltaic panel full set price

- China-Africa solar fan prices

- Water cooling of communication base station energy management system

- Advantages and disadvantages of DC high frequency inverter

- Hybrid inverter mppt in China in Turkmenistan

- 1 kW solar home

- Outdoor power supply and power battery weight

- China-Africa BMS battery management power system architecture

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.