Middle East and Africa Industrial Uninterruptible Power Supply (UPS

Feb 15, 2025 · Opportunity and Strategy Analysis This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa industrial uninterruptible power

Middle East and Africa Modular Uninterruptible Power Supply

Jan 24, 2025 · In the balanced view, the Middle East and Africa modular uninterruptible power supply (MUPS) market is expected to reach $864.9 million by 2033, growing by 9.1% annually

Middle East and Africa Healthcare Uninterruptible Power Supply (UPS

Mar 12, 2025 · Opportunity and Strategy Analysis This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa healthcare uninterruptible power

Middle East and Africa Industrial Uninterruptible Power Supply (UPS

This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa industrial uninterruptible power supply (UPS) market within the forecast period. It

Middle East and Africa Uninterruptible Power Supply (UPS)

Sep 17, 2024 · Opportunity and Strategy Analysis This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa uninterruptible power supply (UPS)

Uninterruptible Power Supplies (UPS) Intelligence Service

3 days ago · Interviews with at least 100 purchase-decision makers at enterprises in at least two major countries. Survey explores investment drivers, barriers, purchasing strategies and top

Middle East & Africa Industrial Uninterruptible Power Supply (UPS

The Middle East & Africa Industrial Uninterruptible Power Supply (UPS) market report offers a thorough competitive analysis, mapping key players'' strategies, market share, and business

旋轉不斷電系統 (UPS) 市場分析與預測(至 2034 年)按

Aug 12, 2025 · 旋轉式不斷電系統 (UPS) 市場預計將從 2024 年的 8 億美元成長至 2034 年的 13 億美元,複合年成長率約為 5%。旋轉式不斷電系統 (UPS) 市場包括利用動能儲能技術在停電期

Middle East and Africa Commercial Uninterruptible Power Supply (UPS

This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa commercial uninterruptible power supply (UPS) market within the forecast period. It

Middle East and Africa Residential Uninterruptible Power Supply (UPS

Feb 13, 2025 · Middle East and Africa Residential Uninterruptible Power Supply (UPS) Market 2023-2033 by Product, Capacity, Power Supply, Marketing Channel, and RegionOpportunity

Middle East and Africa Residential Uninterruptible Power Supply (UPS

This report focuses on identifying opportunities and strategies for investing in the Middle East and Africa residential uninterruptible power supply (UPS) market within the forecast period. It

6 FAQs about [Uninterruptible Power Supply Enterprise Procurement in East Africa]

What is the uninterruptible power supply market?

Based on application, the uninterruptible power supply market is segmented into BFSI, data center, healthcare, telecommunication, industrial applications, government & defense, and others. The data center segment was valued at USD 3.9 billion in 2024 and is expected to grow at a rate of around 6.2% till 2034.

Which country has the largest uninterruptible power supply market?

U.S. accounted for over 75% share in North America uninterruptible power supply market, generating revenue of USD 3.6 billion in 2024. The US has the biggest national market of UPS systems, which have been prompted by the presence of key technology firms and advanced data facility build-up.

How big is the uninterruptible power supply market in 2024?

The solution segment dominated with over 80% market share, generating around USD 9.5 billion in 2024. What is the market size of the uninterruptible power supply (UPS) market in 2024? The market was valued at USD 12.1 billion in 2024, with a projected CAGR of 5.6% from 2025 to 2034. What is the projected value of the UPS market by 2034?

Which countries use uninterruptible power supplies (UPS) in 2024?

Legrand in October 2024 has launched its Keor MOD range of uninterruptible power supplies (UPS) in Europe that uses hot-swappable power modules, with intelligent energy management. France is also an important market of UPS systems owing to the government developments in digitization and smart city construction.

What is Asia Pacific uninterruptible power supply market?

The Asia Pacific uninterruptible power supply market is anticipated to witness lucrative growth between 2025 and 2034. China is the largest market in Asia pacific that has been facilitated by huge investments in data center infrastructure and industrial automation.

What is alternative power solutions in the East African region?

Our aspiration is to provide alternative power solutions in the East African Region. We provide unique specialized services tailored to meet the requirements of the region in terms of Solar, Wind Powered Equipment, Uninterruptible Power Supply (UPS) as well as Power Backup Systems.

Random Links

- Battery cabinet short-circuit current size factors

- China smart hybrid inverter factory Price

- Jamaica brand photovoltaic panel manufacturer

- Apia Outdoor Power Supply Customization

- 3D communication 5g micro base station construction

- India container photovoltaic energy storage wholesale

- Italian emergency energy storage power supply manufacturer

- Hundred-megawatt electrochemical energy storage

- Sodium-ion batteries seize energy storage

- Yaounde energy storage container price

- Find 72 volt inverter

- Palikir Electric Power Station establishes energy storage

- 48V UPS Uninterruptible Power Supply

- Is it okay to use a 48V inverter for a base station

- Pakistan energy storage power station profit model

- Marseille air-cooled energy storage project

- Juba Outdoor Power Quality

- Thimphu energy storage export

- Hot sale metal clad switchgear factory Buyer

- Energy storage product costs

- Burundi outdoor communication battery cabinet parameters

- Best wholesale 10a circuit breaker Price

- Cheap trisquare switchgears factory Price

Residential Solar Storage & Inverter Market Growth

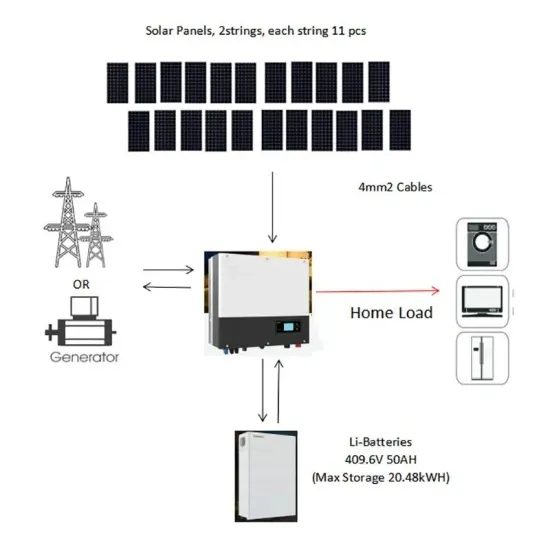

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.