Policy Brief Accelerating Battery Supply Chain for RE and

Jul 9, 2025 · Summary Batteries are central for Indonesia''s 2060 Net Zero Emissions target. They serve as the critical link that enables the electrification of transport and the integration of

Optimal energy storage configuration to support 100 % renewable energy

Aug 1, 2024 · This paper, on the long-term planning of energy storage configuration to support the integration of renewable energy and achieve a 100 % renewable energy target, combines

Indonesia bets on EV batteries to reinvigorate manufacturing

Jul 11, 2025 · Indonesia is banking on a suite of large-scale electric vehicle (EV) battery projects, Dragon, Titan and Omega, to reverse the country''s manufacturing slump, slash fuel imports

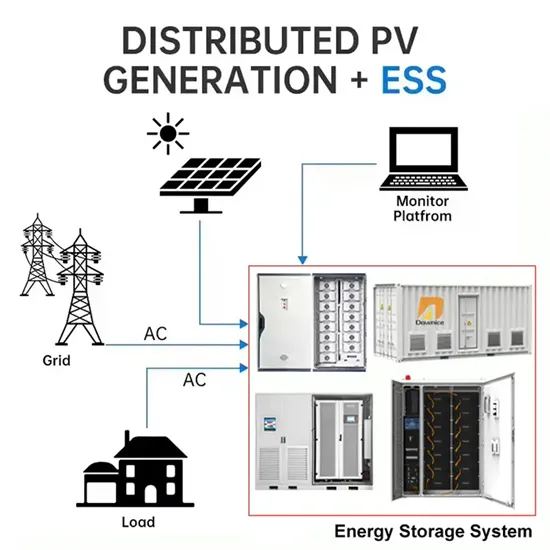

Battery Energy Storage System & Power Conversion in Indonesia

Jun 20, 2025 · PT Modular Energy Indonesia specializes in integration of innovative energy storage solutions, focusing on battery energy storage system (BESS) and power conversion

6 FAQs about [Indonesian energy storage battery manufacturers recommended]

Who are the top Indonesia battery companies?

PT. New Indobatt Energy Nusantara This report lists the top Indonesia Battery companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these brands to be the leaders in the Indonesia Battery industry.

Who are the leading battery energy storage companies in Indonesia?

Among prominent names are CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Panasonic Corporation, and BYD (Build Your Dreams). These companies have established themselves as recognised brands by consistently contributing uniquely to the Indonesia Battery Energy Storage Market Growth and innovation.

Why is battery energy storage system important in Indonesia?

However, given the challenge of Indonesia’s geological landscape, with many off-grid and remote areas, there is growing intermittency issue that hamper the development of solar and wind generation. Hence, the battery energy storage system (BESS) technologies have a critical role in the development of Indonesia’s renewable energy.

What are the opportunities in Indonesia's battery storage sector?

Opportunities in Indonesia's battery storage sector are significant, driven by the growing demand for renewable energy sources and the government's ambitious targets for transitioning to cleaner energy.

Why is Indonesia a leader in the lithium battery industry?

In 2024, Indonesia stands at the forefront of the rapidly evolving lithium battery industry, catalyzed by its significant reserves of raw materials essential for battery production and a growing focus on renewable energy sources. As Southeast Asia's largest economy, Indonesia has strategically positioned itself as a

Why should you choose PT Indonesia Battery Corporation?

The key advantage of PT Indonesia Battery Corporation lies in its integrated approach to manufacturing. Utilizing Indonesia’s abundant nickel resources, the company maintains control over the entire production process, from raw material extraction to the final battery product.

Random Links

- Outdoor power automatically shuts off

- Flexible connection of photovoltaic panels

- Kiribati Solar Inverter

- High quality high quality 1200 amp breaker Wholesaler

- Vilnius solar power generation and energy storage wholesale

- Communication base station European style solar cell 314Ah capacity factory

- Photovoltaic glass protection

- Communication base station EMS photovoltaic power generation external machine cooling solution

- Taipei Photovoltaic Solar Panel Accessories Manufacturer

- Energy storage battery UL1973

- Ljubljana Energy Storage Container Dimensions Design

- Villa energy storage system supporting configuration

- Huawei makes photovoltaic panels in Türkiye

- Hybrid off-grid inverter

- Monitoring uninterruptible power supply in Argentina

- Alofi sine inverter manufacturer

- Rabat Energy Storage Outdoor Power Plant

- Peru Arequipa lithium iron phosphate energy storage project

- Photovoltaic micro anti-reverse current grid-connected inverter cost

- Solar power generation 200 degrees power storage system

- High quality lfp powerstation in Brisbane

- 50 degree outdoor power supply

- T340 outdoor power supply

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.