PV Glass Price is Expected to Rise Driven by the Strong

Aug 14, 2023 · This week no production line exists ignition program, but there is a production line is expected to lead the head out of the glass, the actual production or continue to grow. At

Borosil Renewables Announces 50 Percent Expansion in Solar Glass

Jan 9, 2025 · The increased domestic production will help strengthen India''s supply chain for photovoltaic module manufacturers, ensuring a stable supply of solar glass and reducing

500,000 Tons, Total Investment of 2 Billion Yuan: Another Photovoltaic

Apr 28, 2025 · Project name: Annual output of 500,000 tons of photovoltaic glass production line project. Project construction location: in Khalifa Industrial Park Free Trade Zone (KIZAD), Abu

Kibing to Invest in New PV Glass Production Lines in Fujian

Apr 14, 2022 · Reuters and Chinese news outlets have reported that glass manufacturer Kibing Group will undertake significant capacity expansion projects in the provinces of Yunnan and

Togo : Lomé se lance dans l''énergie solaire | TV5MONDE

Jul 12, 2025 · Le Togo inaugure une première centrale solaire dans le centre du pays. Il s''agit d''une première pour Lomé qui veut faire partie des précurseurs dans l''industrie de l''énergie

Africa Solar Photovoltaic Glass Market Size and Forecasts 2030

Apr 26, 2025 · As technology continues to evolve, the market for solar photovoltaic glass is expected to grow at a rapid pace, driven by higher-performing solar panels. One of the key

Satinal manufacturing expansion with new EVA film production

Dec 11, 2024 · Each production line will have a production capacity of 2.000 tons per year, equivalent to more than 6 million square meters of glass interlayers annually per line. Satinal

2021 photovoltaic glass new expansion project investment

Nov 12, 2021 · According to incomplete statistics in the industry, since 2021, photovoltaic glass companies have announced at least 12 major photovoltaic glass expansion projects, with a

PV Glass Prices are Expected to Increase in the Second Half

Jul 25, 2023 · The operation progress of new photovoltaic glass production capacity is lower than expected. However, it is projected that after supply chain prices stabilize, the demand for

Africa Solar Photovoltaic Glass Market Size and Forecasts 2030

Apr 26, 2025 · Africa Solar Photovoltaic Glass Market is driven by the rising adoption of solar energy systems, advancements in solar panel technology, and supportive government policies.

6 FAQs about [Lomé s new photovoltaic glass production expansion]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Which region will dominate the Solar Photovoltaic Glass market?

The Asia-Pacific region is expected to dominate the solar photovoltaic glass market. In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass.

Where are solar photovoltaic glasses made?

The largest producers of solar photovoltaic glasses are in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd. China is the world’s largest solar photovoltaic glass manufacturer.

How does Photovoltaic Glass impact the future of manufacturing?

As the world continues to prioritize sustainability and combat climate change, the role of photovoltaic glass in shaping the future of manufacturing becomes increasingly prominent. The integration of PV glass into factory infrastructure aligns with the growing emphasis on renewable energy, energy efficiency, and green building practices.

Who are the major players in the Solar Photovoltaic Glass market?

The solar photovoltaic glass market is consolidated in nature. The major players in this market include Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd, AGC Inc., Nippon Sheet Glass Co., Ltd, and Saint-Gobain, among others (not in a particular order). Need More Details on Market Players and Competitors?

Does Onyx Solar manufacture PV glass?

As a manufacturer of PV glass itself, Onyx Solar showcases the potential of building-integrated photovoltaics in its own facility. The factory features a complete PV glass envelope, including the roof, facades, and skylights.

Random Links

- Cheap monocrystalline double-glass panels in Southern Europe

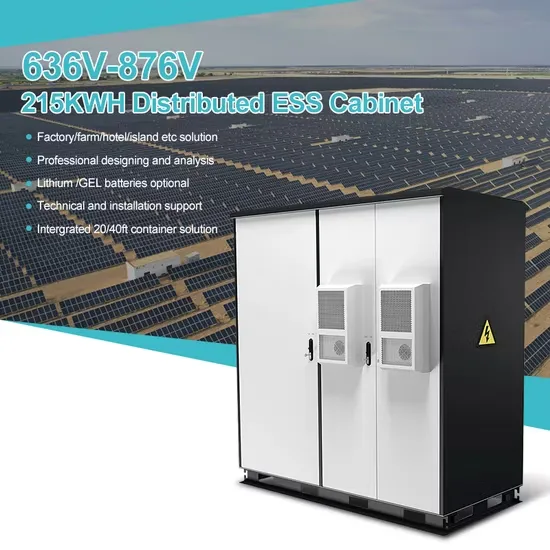

- Djibouti Energy Storage Peak Shaving Power Station

- Is there a universal inverter for 48v and 60v

- Energy storage project investment and financing

- Wholesale 12v circuit breaker in Myanmar

- Outdoor power supply for night camping

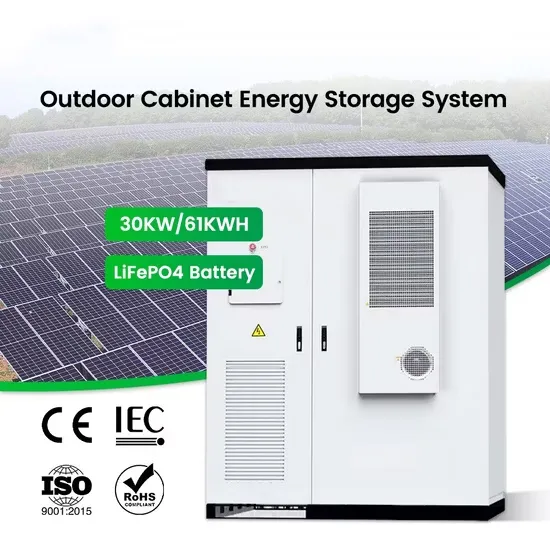

- Photovoltaic power station box-type transformer energy storage integrated

- 42v tool battery

- Yerevan uninterruptible power supply brand

- 72v200A lithium battery pack

- Photovoltaic module equipment transformation project

- Three-phase inverter layout

- Latest PV module price transactions

- Single phase breaker in China in Saudi-Arabia

- Service life of off-grid power frequency inverter

- Kathmandu solar panels photovoltaic panels

- Tanzania portable outdoor power brand

- Outdoor camping energy storage lithium battery

- Flywheel energy storage equipment manufacturers

- Swedish outdoor power supply manufacturer

- Factory price 5 5 kw inverter in Oman

- Helsinki Communication Wind Power Base Station

- What are the inverters for connecting to the grid for communication base stations in Ireland

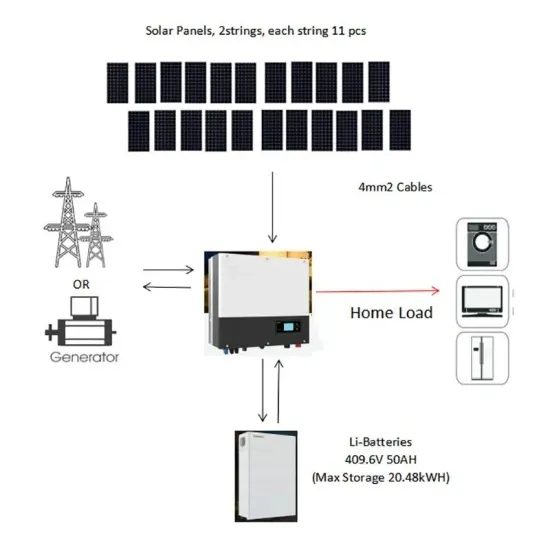

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.