Economic Benefit Analysis of Battery Energy Storage Power Station

May 30, 2020 · It evaluates the cost-effectiveness by using the indexes of income flow, net present value, dynamic investment payback period and intrinsic rate of return. The results

Optimal capacity planning and operation of shared energy storage

May 1, 2023 · A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale integrated 5G base stations is proposed to

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · To maximize overall benefits for the investors and operators of base station energy storage, we proposed a bi-level optimization model for the operation of the energy storage,

Profitability of energy arbitrage net profit for grid-scale battery

Aug 1, 2024 · The present work proposes a long-term techno-economic profitability analysis considering the net profit stream of a grid-level battery energy storage system (BESS)

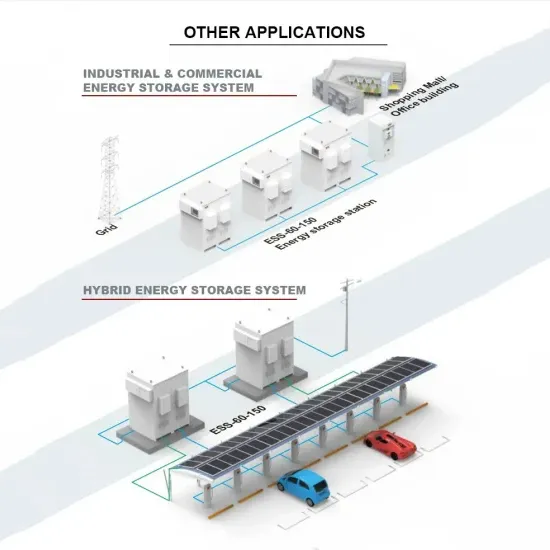

Comprehensive benefits analysis of electric vehicle charging station

Jun 15, 2021 · Photovoltaic–energy storage charging station (PV-ES CS) combines photovoltaic (PV), battery energy storage system (BESS) and charging station together. As one of the most

Profitability of energy arbitrage net profit for grid-scale battery

Aug 1, 2024 · We found that, even without degradation, the break-even investment cost that makes the BESS profitable with a power to-energy-ratio of 1 MW/2MWh is 210 $/kWh. By

Strategy of 5G Base Station Energy Storage Participating in

Mar 13, 2023 · The proportion of traditional frequency regulation units decreases as renewable energy increases, posing new challenges to the frequency stability of the power system. The

Economic Analysis of Energy Storage Stations: Costs, Profits,

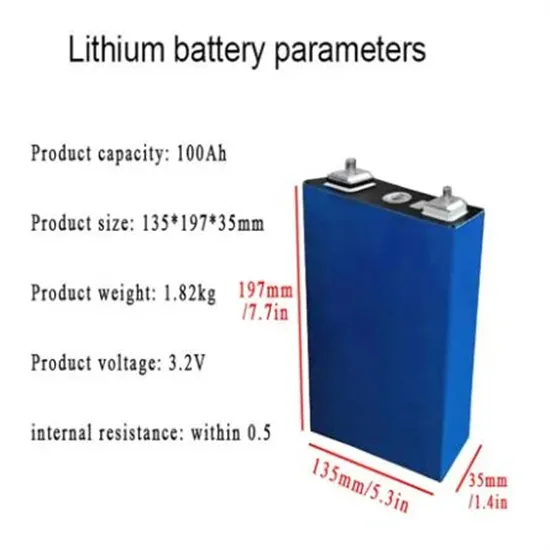

Jun 22, 2022 · Let''s slice through the financial layers of a typical 100MW/200MWh lithium-ion storage station: Initial investments (60-80% of total cost): Battery systems still eat up 50-60%

Energy Storage Grand Challenge Energy Storage Market

Dec 18, 2020 · This report covers the following energy storage technologies: lithium-ion batteries, lead–acid batteries, pumped-storage hydropower, compressed-air energy storage, redox flow

Optimal capacity planning and operation of shared energy storage

May 1, 2023 · A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale PV integrated 5G base stations is proposed to

Understanding the Return of Investment (ROI): battery energy storage

2 days ago · In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can

6 FAQs about [Base station energy storage battery profit analysis]

What factors influence the ROI of a battery energy storage system?

Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control.

How do I assess the ROI of a battery energy storage system?

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control. External Factors that influence the ROI of a BESS

Does battery degradation affect Bess profitability?

We found that, even without degradation, the break-even investment cost that makes the BESS profitable with a power to-energy-ratio of 1 MW/2MWh is 210 $/kWh. By implementing a cycle-counting degradation model, we observed a remarkable battery degradation on BESS profitability corresponding to a yearly net profit reduction in the 13–24 % range.

Does a grid-level battery energy storage system perform energy arbitrage?

The present work proposes a long-term techno-economic profitability analysis considering the net profit stream of a grid-level battery energy storage system (BESS) performing energy arbitrage as a grid service.

What is the traditional configuration method of a base station battery?

The traditional configuration method of a base station battery comprehensively considers the importance of the 5G base station, reliability of mains, geographical location, long-term development, battery life, and other factors .

Are battery energy storage systems a low-carbon flexible resource?

1. Introduction In the modern power network, battery energy storage systems (BESS) are playing a crucial role as low-carbon flexible resources, due to their ability to address renewable energy intermittency and to provide a wide range of grid services (e.g., energy arbitrage, frequency regulation, load-shifting) .

Random Links

- Egypt environmentally friendly solar energy system wholesale

- Which battery cabinet is good to use in Abuja now

- Romanian communication energy storage battery

- Solar power panel system 12v photovoltaic panel 100w

- Dushanbe makes energy storage containers

- Photovoltaic energy storage installed in Kigali

- Lithium battery energy storage growth

- Can lithium battery packs be fully discharged

- Cheap solar power system for cabin Buyer

- Which companies have energy storage power stations in Brazil

- Vaduz single supercapacitor price

- Honduras Super Hybrid Capacitor

- DC generator connected to inverter

- American solar energy storage cabinet lithium battery

- Polish shopping mall photovoltaic curtain wall brand

- Villa outdoor solar lighting system

- Roman rooftop photovoltaic energy storage

- Large lithium battery with inverter

- Mechanical energy storage fan price

- Nuku alofa wind power storage

- Kenya Energy Storage Frequency Regulation Project

- Uninterruptible power supply equipment BESS manufacturer processing

- Uninterruptible power supply equipment for Skopje Electric Power

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.