Sino-Moroccan Venture Begins Battery Materials Production in Morocco

Jun 26, 2025 · COBCO, a joint venture between Morocco''s Al Mada investment fund and China''s CNGR Advanced Materials, has commenced production of lithium-ion battery components at

Morocco''s path to a climate-resilient energy transition:

Apr 19, 2024 · These scenarios consider different levels of renewable penetration, accounting for factors such as the influence of thermal and Battery Energy Storage (BES), production and

Energy storage: Morocco bets on LFP batteries to accelerate

Jun 5, 2025 · To address this, Morocco is resolutely focusing on lithium iron phosphate (LFP) batteries, a reliable, durable technology suited to local constraints. This choice is part of a

6 FAQs about [Morocco Casablanca 12v500ah energy storage battery]

How much will EV batteries cost in Morocco?

In June this year, the Moroccan government announced that Gotion High-Tech would invest $1.3 billion (US) to build a gigafactory for EV batteries. The initial planned production capacity is 20 GWh, with future plans to gradually increase it to 100 GWh, and the total investment is expected to reach $6.5 billion.

How much did Morocco invest in a battery factory?

In June, the Moroccan government signed an investment agreement with Gotion for a battery factory with a total investment of 12.8 billion dirhams ($1.3 billion) and an initial battery capacity of 20 GWh.

Will a Moroccan EV battery plant be a key supplier?

The company said on the official Moroccan government website that the facility aims to be a key supplier to the EV batteries and stationary energy storage markets. The 238-hectare plant at Jorf Lasfar, will have an eventual annual 70 GWh production capacity.

Does sunwoda have a battery production base in Morocco?

Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger. In April this year, Zhongke Electric planned to invest about $699 million (US) to implement an integrated base project for producing 100,000 tons/year of anode materials in Morocco.

Which Chinese lithium battery companies are based in Morocco?

Since 2023, several Chinese lithium battery industry chain companies, including CATL, Gotion High-Tech, Sunwoda, BTR, Huayou Cobalt, CNGR Advanced Material and Tinci Materials, have collectively invested in Morocco and built factories. The battery industry chain centered around LFP is forming rapidly.

Does CATL have a battery production base in Morocco?

CATL has already planned over 100 GWh of production capacity at its European factories. Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger.

Random Links

- 5G base station power supply voltage

- Estonia inverter 6kw single phase

- Sf6 circuit breaker in hindi in Los-Angeles

- Photovoltaic energy storage and transmission

- 12Kw48v inverter

- Base station communication equipment voltage range

- China samite circuit breaker in Lithuania

- Active generator photovoltaic power station

- Which is better high frequency inverter or industrial frequency inverter

- Single-family energy storage equipment

- Inverter corresponding battery specifications

- Inverter power design

- Photovoltaic panel delivery price

- Best wholesale breaker with outlet manufacturer

- Serbia home solar garden lights

- Double-glass bifacial and double-glass single-sided modules

- 15kW energy storage battery

- China 3 phase hybrid inverter in Panama

- Which outdoor power supply is recommended in Tbilisi

- How much current does a 50 kW energy storage generator have

- Wind power source in base station

- Base station outdoor lightning protection

- Single-phase inverter topology

Residential Solar Storage & Inverter Market Growth

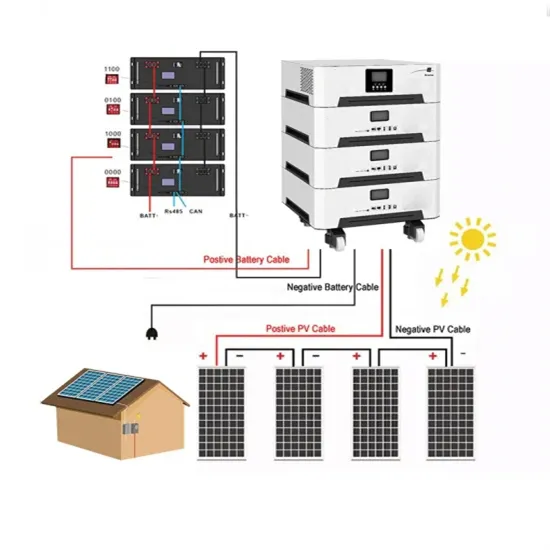

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.