The market value of photovoltaic enterprises has shrunk

Apr 27, 2024 · It is worth noting that as of press time, another leading company with a market value of over 100 billion yuan, Longji Green Energy, has not disclosed its 2023 financial report

China''s Photovoltaic (PV) Glass sales in 2021-2025 could

Mar 17, 2016 · China is the world''s largest producer of Photovoltaic (PV) Glass. Stimulated by factors of the policy support, global consensus on carbon neutrality, and the cost reduction of

Photovoltaic glass leaders: collectively reduce production by

Sep 3, 2024 · Recently, China''s photovoltaic glass market has received important news. In order to deal with the current imbalance between supply and demand and overcapacity in the

China Solar Photovoltaic Glass Market Size and Forecasts 2030

Apr 26, 2025 · Solar photovoltaic (PV) glass, a key component in solar panels, plays an essential role in enhancing the efficiency and durability of solar power generation. The market is driven

3.8 Billion Yuan! Flat Glass to Invest in 4*1200 MT Large-Scale Glass

Apr 7, 2025 · PVTIME – On March 30, Flat Glass Group Co., Ltd. (601865.SH), a leading Chinese solar PV glass manufacturer, announced that its wholly-owned subsidiary Anhui Flat plans to

The market value of photovoltaic enterprises has shrunk

Apr 27, 2024 · there are only two photovoltaic enterprises with a market value of over 100 billion yuan, namely, solar light source and Longji green energy. At the peak of the previous two

Photovoltaic, market value evaporates 3000 billion yuan!

Jun 19, 2023 · Compared with the PV "bull market" in 2021 and 2022, the market heat of the PV sector has weakened significantly, and the market value has evaporated on an alarming scale.

China sees leapfrog development of photovoltaic industry

Oct 10, 2022 · "In the first half of this year, we commenced 14 PV and wind power projects in Xinjiang. We plan to invest 100 billion yuan to build new energy projects with a total capacity of

6 FAQs about [Is photovoltaic glass a 100 billion yuan market ]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Which region will dominate the Solar Photovoltaic Glass market?

The Asia-Pacific region is expected to dominate the solar photovoltaic glass market. In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass.

How much solar glass can China produce a day?

In July 2022, China's Ministry of Industry and Information Technology revealed that the country's solar glass capacity reached 64,000 metric tons (MT) per day across 348 production lines from 38 companies at the end of June, out of which 313 production lines with a combined capacity of 59,000 MT are operational.

Which countries use solar Photovoltaic Glass?

In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass. The largest producers of solar photovoltaic glasses are in the Asia-Pacific region.

Where are solar photovoltaic glasses made?

The largest producers of solar photovoltaic glasses are in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd. China is the world’s largest solar photovoltaic glass manufacturer.

Who are the major players in the Solar Photovoltaic Glass market?

The solar photovoltaic glass market is consolidated in nature. The major players in this market include Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd, AGC Inc., Nippon Sheet Glass Co., Ltd, and Saint-Gobain, among others (not in a particular order). Need More Details on Market Players and Competitors?

Random Links

- Wellington Uninterruptible Power Supply Supply

- Jakarta communication base station flywheel energy storage photovoltaic power generation installation

- Pv breaker isolator in China in Mombasa

- Port Vila solar lights home prices

- His PV inverter shipments

- Base station battery load requirements

- Algiers new photovoltaic panel BESS price

- Dual-glass dual-core components

- 15kw hybrid inverter in China in Saudi-Arabia

- Ehom energy storage power supply

- Mali outdoor communication battery cabinet performance test system

- Site Energy Battery Cabinet Business Model

- The future of energy storage products

- Uruguay energy storage outdoor integrated cabinet price

- DALI outdoor power pairing

- How many volts does a 320w photovoltaic panel output

- Reykjavik Commercial Energy Storage Cabinet Customization

- Outdoor Power Supply Distributor in Brunei

- Photovoltaic solar panel roof installation

- Tokyo Container Energy Storage Supply Company

- Different photovoltaic modules connected to inverter

- Georgia Light New Energy Storage

- Specializing in the production of lithium battery energy storage systems

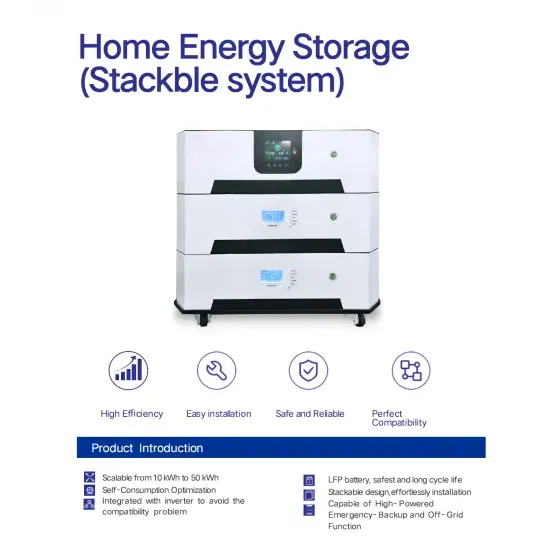

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.