US proposes 10% tariffs on inverters, AC modules, non

Jul 11, 2018 · As the trade war escalates, PV inverters, solar panels with attached microinverters and battery storage products other than those which utilize lithium-ion chemistry, may be the

Impact of adjusted Section 301 tariffs on solar industry

Sep 17, 2024 · Notably, the adjusted 301 tariff expands to cover Chinese exports of polysilicon and mono-Si wafers, with a 50% tariff rate set to take effect on January 1, 2025. This move is

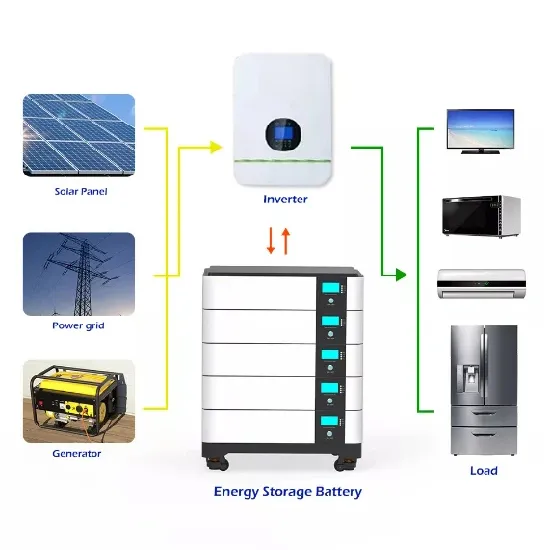

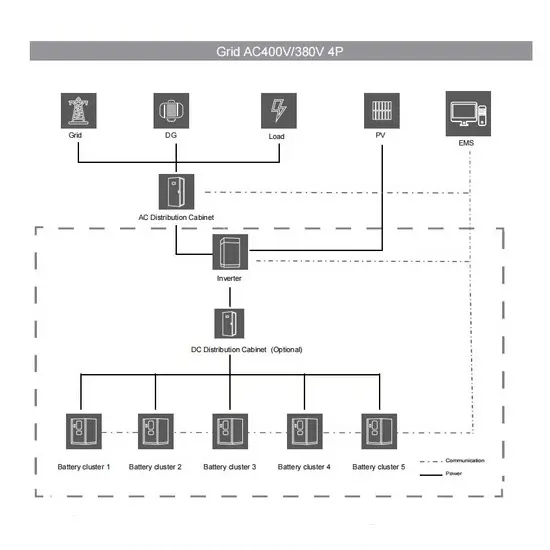

Smart Energy, Smarter Living: Revolutionizing Home Energy

Apr 22, 2025 · In the age of renewable energy and smart technology, the way we manage power in our homes is undergoing a major transformation. As more people install PV, battery storage,

The Ripple Effect of 2025 Tariffs on the U.S. Solar Industry

Mar 12, 2025 · A Snapshot of the 2025 Tariffs In March 2025, the U.S. government introduced a series of tariffs targeting imports from key trading partners, including Canada, Mexico, and

How Will the Increase of Section 201 Tariff Rate Quota to

Nov 5, 2024 · Explore how the increase in the Section 201 tariff rate quota to 12.5 GW impacts the U.S. PV market, with insights on strategic implications for companies navigating supply chain

Mixed impact of proposed Section 301 tariffs on inverter makers – pv

Jul 12, 2018 · The inclusion of inverters in the 10% tariffs proposed for $200 billion worth of Chinese products will not make or break the U.S. solar market. Compared to the Section 201

Sungrow Unveils "Dynamic Tariff" Feature on iSolarCloud:

Apr 16, 2025 · As Europe accelerates its adoption of dynamic tariff mechanisms, Sungrow, the global leading PV inverter and energy storage system provider, has upgraded its iSolarCloud

Rise of Chinese Solar Inverter Manufacturing Amidst Global Tariff

May 31, 2025 · In the face of these tariffs, the future outlook for China''s solar inverter industry remains optimistic. Projections indicate substantial growth in the solar microinverter market,

Analysis of the Impact of U.S. Tariff Escalation and China''s

Apr 9, 2025 · The cumulative tariff rate on energy storage inverters from China to the U.S. has increased from an initial base rate of 2.5% to 81.5% (including a 45% tariff under Section 301

U.S. Imposes Historic 104% Tariffs on Chinese Imports, Forcing Solar

Apr 10, 2025 · China''s photovoltaic (PV) sector, already struggling under previous U.S. tariffs, faces an existential threat. Direct exports of Chinese solar panels to the U.S. had already

6 FAQs about [PV inverter tariffs]

How will April tariffs affect inverters & solar panels?

Overall, while the solar panel price spike is the most pronounced effect of the April tariffs, inverters are seeing a noticeable cost increase as well, on the order of a few cents per watt.

How will trump's new tariffs affect solar inverters?

The Trump administration on Monday unveiled long-awaited tariffs on $200 billion in Chinese goods. The new round of duties, under Section 301, will hit yet another slice of the solar market: inverters. In a statement, the administration said tariffs of 10 percent would go into effect on September 24. They’ll rise to 25 percent on January 1.

What is the new tariff policy for inverters?

Under the new policy, all imports face at least 10% tariff, and specific countries face more – China-made inverters now see ~34% tariff, European inverters ~20%, South Korea 25%, etc.

Why do solar panels have a 25% tariff?

For example, 25% tariffs on steel and aluminum are felt not only by racking suppliers but also solar panel manufacturers as frames are typically made of aluminum. Outside of cells, frames are the single most expensive sub-component in a solar module, so a 25% duty may increase the cost by a few cents per watt on American-made solar modules.

Are microinverters tariff-free?

Some microinverters and power electronics, which often were made in Asia, are similarly affected – however, companies like Enphase (U.S.) anticipated tariffs and diversified manufacturing to Mexico and India in recent years, meaning a portion of inverter supply is tariff-free.

Which solar companies do not incur import tariffs?

Other “Domestic” Suppliers: A few manufacturers with U.S.-based production or assembly – such as Hanwha Qcells (Georgia factories), First Solar (Ohio), Mission Solar (Texas), and Silfab (Washington) – do not incur these import tariffs on their U.S.-made panels. They have an effective price advantage now.

Random Links

- How big an inverter should I use for a 60v20ah lithium battery

- What is a wind power energy storage station good for

- Inverter 24 volt price

- BESS outdoor base station power supply is cheap

- Skopje lithium battery station cabinet factory to store electrical energy

- ASEAN builds photovoltaic panel manufacturers

- Nader circuit breaker factory in Zimbabwe

- High quality 6000w solar inverter for sale supplier

- 6000w solar inverter for sale in Bahrain

- The role of flow battery photovoltaic power generation

- Astana energy storage inverter price

- Paris lithium battery pack factory

- Solar 5000w photovoltaic panel price

- Industrial and commercial photovoltaic energy storage cooperation model

- Energy storage cabinet as auxiliary power generation equipment for solar energy system

- Lithium battery energy storage and discharge mode

- What is the normal voltage of the base station power supply

- Rabat high frequency inverter installation factory

- Seychelles communication base station inverter grid connection requirements

- Photovoltaic solar panels installed in Israel

- Power conversion for off-grid inverters

- What does 20 watts of solar energy mean

- China high voltage switchgear in Vancouver

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.