Status and prospects of energy efficiency in the glass industry

Oct 1, 2024 · The significant share of energy-related emissions in the glass industry necessitates robust energy efficiency strategies. This paper evaluates the status and prospects of energy

Energy Storage Battery Container Market Analysis and Future Prospects

May 8, 2024 · The energy storage battery container market represents a multifaceted and continually evolving realm, influenced by shifting consumer demands and technological

analysis of the current situation and prospects of energy storage industry

Natural gas industry in China: Development situation and prospect China''''s natural gas industry has entered a rapid development stage, and its supply, sales, storage and transport systems

Energy Storage Containers Analysis Uncovered: Market

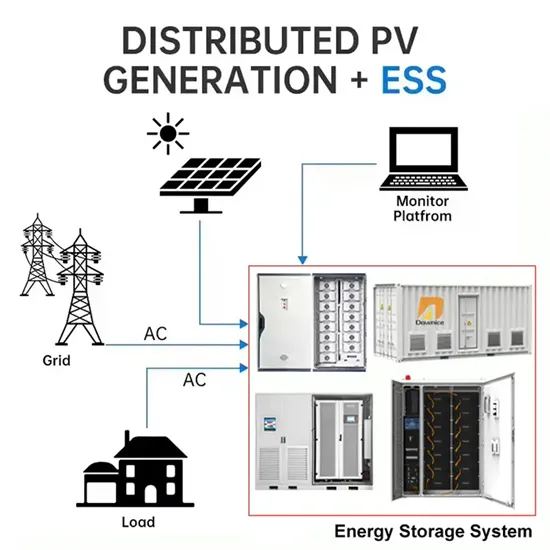

Jun 2, 2025 · The global energy storage container market is experiencing robust growth, driven by the increasing demand for renewable energy integration, grid stabilization, and backup power

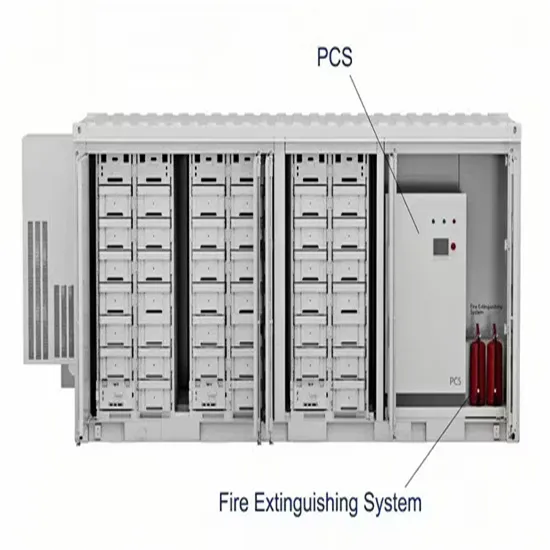

Decommissioned Power Battery Digital Energy Storage System Container

Feb 1, 2025 · Market Analysis for Decommissioned Power Battery Digital Energy Storage System Container The global market for decommissioned power battery digital energy storage system

Exploring Growth Avenues in Container Type Energy Storage Systems Market

May 10, 2025 · The global market for containerized energy storage systems (CESS) is experiencing robust growth, driven by the increasing demand for reliable and scalable energy

The Future of Energy Storage: An In-Depth Analysis of the

May 24, 2023 · Dive into the world of Battery Energy Storage Systems (BESS) and explore their crucial role in the global energy landscape. This comprehensive article provides an in-depth

6 FAQs about [Analysis of the prospects of energy storage container industry]

What is the growth rate of industrial energy storage?

The majority of the growth is due to forklifts (8% CAGR). UPS and data centers show moderate growth (4% CAGR) and telecom backup battery demand shows the lowest growth level (2% CAGR) through 2030. Figure 8. Projected global industrial energy storage deployments by application

What is the energy storage Grand Challenge?

This report, supported by the U.S. Department of Energy’s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected energy storage technologies in the transportation and stationary markets.

Where will stationary energy storage be available in 2030?

The largest markets for stationary energy storage in 2030 are projected to be in North America (41.1 GWh), China (32.6 GWh), and Europe (31.2 GWh). Excluding China, Japan (2.3 GWh) and South Korea (1.2 GWh) comprise a large part of the rest of the Asian market.

What is the growth rate of stationary storage in 2030?

By 2030, annual global deployments of stationary storage (excluding PSH) is projected to exceed 300 GWh, representing a 27% compound annual growth rate (CAGR) for grid-related storage and an 8% CAGR for use in industrial applications such as warehouse logistics and data centers.

Which storage chemistry can meet DC market performance requirements?

Another new storage chemistry that provides both high power and very long cycle life, Prussian blue chemistry, can meet the demanding DC market performance requirements. DOE funded a startup with this chemistry and their 2020 launch exceeds 50,000 kW . Li-ion batteries are deployed in both the stationary and transportation markets.

Will Li-ion capture energy storage growth in the next 10 years?

Most analysts expect Li-ion to capture the majority of energy storage growth in all markets over at least the next 10 years , , , , . Li-ion is the fastest-growing rechargeable battery segment; its global sales across all markets more than doubled between 2013 and 2018.

Random Links

- Wellington Uninterruptible Power Supply Supply

- Jakarta communication base station flywheel energy storage photovoltaic power generation installation

- Pv breaker isolator in China in Mombasa

- Port Vila solar lights home prices

- His PV inverter shipments

- Base station battery load requirements

- Algiers new photovoltaic panel BESS price

- Dual-glass dual-core components

- 15kw hybrid inverter in China in Saudi-Arabia

- Ehom energy storage power supply

- Mali outdoor communication battery cabinet performance test system

- Site Energy Battery Cabinet Business Model

- The future of energy storage products

- Uruguay energy storage outdoor integrated cabinet price

- DALI outdoor power pairing

- How many volts does a 320w photovoltaic panel output

- Reykjavik Commercial Energy Storage Cabinet Customization

- Outdoor Power Supply Distributor in Brunei

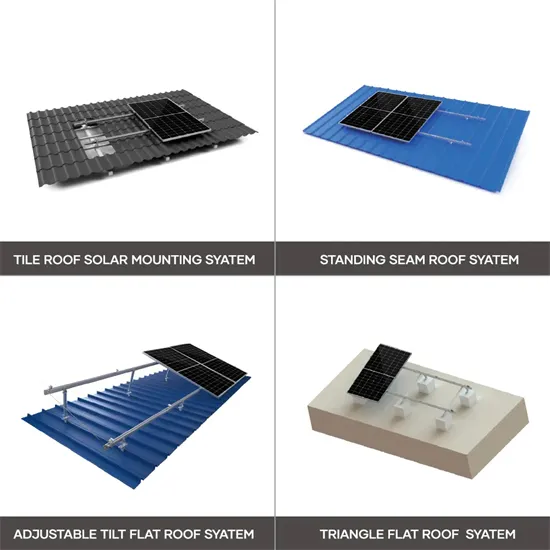

- Photovoltaic solar panel roof installation

- Tokyo Container Energy Storage Supply Company

- Different photovoltaic modules connected to inverter

- Georgia Light New Energy Storage

- Specializing in the production of lithium battery energy storage systems

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.