The Ethiopian telecom industry: gaps and recommendations

Oct 1, 2021 · Ethiopia, the second-most populous country in Africa with 110 million inhabitants, has one of the oldest public telecommunication operators established in 1894. Despite its age,

Ethio Telecom''s Share Offering Explained: What Every

Oct 17, 2024 · Ethio Telecom, Ethiopia''s dominant telecom provider, is in the process of partial privatization. The company is offering 100 million ordinary shares at ETB 300 per share, with

Ethio telecom 2023/2024 Annual Business Performance Report

Jul 10, 2024 · We are Africa''s Pioneer telecom provider, offering reliable connectivity, advanced technology, and financial services to simplify life as we drive Ethiopia''s digital transformation

6 FAQs about [Ethiopia s telecommunications base station supercapacitors are shut down]

Is the Ethiopian telecom industry under-covered?

Regarding research, the Ethiopian telecom industry is under-covered. However, as discussed earlier, Ethiopia continues to suffer substantial negative consequences from having one of the worst telecommunications services in the world.

Why does Ethiopia need massive telecom infrastructure investment?

Therefore, Ethiopia requires massive telecom infrastructure investment due to the existing large-scale limits of network coverage, middle-mile and first-mile connectivity. Such a substantial infrastructure and funding gap requires effort from all stakeholders.

Does Ethio Telecom have 2G coverage in Addis Ababa?

The TEP project promised to increase 2G coverage from 64% to 90%, improve 3G network coverage in rural areas and introduce LTE in Addis Ababa ( Wall Street Journal, 2014 ). However, currently, Ethio Telecom has around 85 percent 2G coverage, 66 percent with 3G, and 4 percent with 4G ( The World Bank, 2019 ).

Can Ethiopian telecom policies & strategies be based on a concrete broadband roadmap?

However, with an additional detailed analysis, this work may be used as a foundation in drawing the Ethiopian telecom policies, strategies, and action-oriented concrete broadband roadmap.

Why is the Ethiopian Telecommunication industry underperforming?

Even though enormous literatures are supporting the significant positive impact of ICT on a country's economy, there is almost no published research work seeking out why the Ethiopian telecommunication industry is underperforming. Regarding research, the Ethiopian telecom industry is under-covered.

Who supervises Telecommunications in Ethiopia?

After the 1996 proclamation, Ethiopian telecom operator used to be supervised by the Ministry of Transport and Communications, later called the Ministry of Development Infrastructures (MDI). The Ministry oversees energy, transportation, and postal services besides telecommunications ( Federal Democratic Republic of Ethiopia, 2001 ).

Random Links

- Batch conversion to photovoltaic glass

- 1000kw energy storage inverter

- Beijing photovoltaic panel manufacturers

- Home energy storage plus generator

- Wireless communication green base station technology maintenance

- Outdoor high power energy storage cabinet solar panels

- Grenada Photovoltaic Panel Accessories Manufacturer

- Which energy storage methods are new energy storage methods

- Pakistan 50 MW solar

- Nigeria Energy Storage Solar Photovoltaic

- Requirements for fire extinguishing equipment in energy storage stations

- China factory price current breaker Wholesaler

- New photovoltaic panel manufacturer in Tampere Finland

- Lithium battery station cabinet high temperature

- 1000w solar inverter for sale in Sudan

- Solar photovoltaic standard panel size

- Outdoor power supply bms merchants in Toronto Canada

- Belgian computer room battery cabinet manufacturer

- Burkina Faso Australia Energy Storage Power

- The country s communication base station with the least lithium-ion batteries

- How much does photovoltaic panel glass account for the cost

- 120kw photovoltaic energy storage power generation and storage integrated machine sales

- Energy Storage and Green Grids

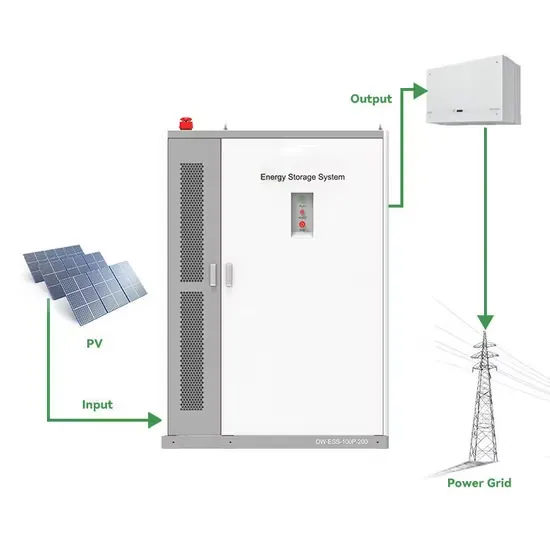

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.