Morocco Advances Energy Storage with Global Call for Battery

Jun 25, 2025 · Morocco is accelerating its energy transition by issuing a global call for expressions of interest to build two large-scale battery storage facilities. The projects are spearheaded by

Morocco deploys 1600 MWh of batteries to stabilise its

Aug 18, 2025 · The Office National de l''Électricité et de l''Eau potable (ONEE) has initiated a battery energy storage project with a total capacity of 1600 megawatt-hours (MWh) to

Acwa Power, Gotion Morocco launch $800 million plant to

Nov 11, 2024 · Acwa signed the joint development agreement with Gotion High-Tech to build the $1.3 billion EV battery gigafactory in Kenitra, Morocco, construction of which is to begin in

Morocco 2025 Energy Storage Exhibition: Gateway to Africa''s

Jan 10, 2020 · Let''s face it – energy storage isn''t exactly the sexiest topic at dinner parties. But what if I told you Morocco''s 2025 Energy Storage Exhibition could be the Woodstock of

Towards a large-scale integration of renewable energies in Morocco

Dec 1, 2020 · The main objective of this paper is to study a scenario for 2030 for the Moroccan electricity system and to identify the challenges that need to be addressed in order to

Morocco begins mass production of EV battery materials at

Jun 30, 2025 · Morocco has begun industrial-scale production of electric vehicle battery materials at the newly inaugurated $2 billion COBCO plant, marking a major step in the country''s bid to

Acwa Power and China''s Gotion partner on $800M Moroccan

Nov 3, 2024 · The wind plant is part of Acwa Power''s expansive $1.8 billion investment initiative, launched at the recent Future Investment Initiative (FII) in Riyadh . Acwa Power and China''s

6 FAQs about [Morocco Casablanca outdoor energy storage battery group]

What's going on with EV batteries in Morocco?

The battery industry chain centered around LFP is forming rapidly. In June this year, the Moroccan government announced that Gotion High-Tech would invest $1.3 billion (US) to build a gigafactory for EV batteries.

Are lithium battery Gigafactories a good idea in Morocco?

The establishment of lithium battery gigafactories in Morocco holds immense promise for the country’s economy and energy sector. These facilities will not only produce lithium batteries for electric vehicles and renewable energy storage systems but also drive advancements in battery technology and manufacturing processes.

Does CATL have a battery production base in Morocco?

CATL has already planned over 100 GWh of production capacity at its European factories. Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger.

Can Morocco be a global leader in battery manufacturing?

By embracing the clean energy transition and positioning itself as a global leader in battery manufacturing, Morocco can drive economic growth, create jobs, and contribute to a more sustainable future for generations to come.

Does sunwoda have a battery production base in Morocco?

Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger. In April this year, Zhongke Electric planned to invest about $699 million (US) to implement an integrated base project for producing 100,000 tons/year of anode materials in Morocco.

Which Chinese lithium battery companies are based in Morocco?

Since 2023, several Chinese lithium battery industry chain companies, including CATL, Gotion High-Tech, Sunwoda, BTR, Huayou Cobalt, CNGR Advanced Material and Tinci Materials, have collectively invested in Morocco and built factories. The battery industry chain centered around LFP is forming rapidly.

Random Links

- Lithium batteries as a form of energy storage

- Bangui Photovoltaic Solar Panel Prices

- High quality magnetic breaker in Lithuania

- Box-type centralized photovoltaic inverter

- Wholesale 16 kw deye inverter in Namibia

- Do base stations and solar panels look the same

- Solar base station flow battery rack

- Tool Battery Field

- Outdoor power supply engineering design solution

- Huawei Nairobi Outdoor Energy Storage

- What is a DC uninterruptible power supply for a power plant

- San Jose Radio Communication Base Station

- China all in one solar system in Portugal

- Energy storage frequency regulation battery price

- Riyadh DC screen inverter

- Estimates of the profit model of energy storage power stations

- The photovoltaic panels with the highest power generation in summer

- UPS uninterruptible power supply battery cabinet installation

- Benefit criteria for battery energy storage

- Energy Storage Battery HIT

- 12v30ah inverter

- Uganda Solar Photovoltaic Power Generation System

- Duplex balcony photovoltaic glass installation

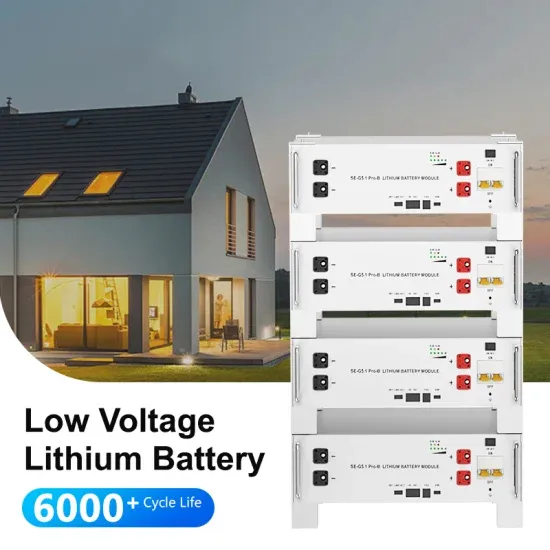

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.