Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · In the day-ahead optimization stage, under the constraint of demand charge threshold and with the goal of maximizing returns, the distributed energy storage is controlled

Peak and Valley Arbitrage_One Profit For C & I Energy Storage System

As an emerging business model, energy storage grid peak-valley spread arbitrage has injected vitality into the electricity market. In this paper, we will discuss what grid peak-valley spread

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · On the other hand, references [35,36] do not consider the impact of energy storage utilizing peak and off-peak electricity price arbitrage on the peak-shaving cost of the power

Optimized operation strategy for energy storage charging

May 30, 2024 · Electric vehicles possess inherent energy storage potential, enabling them to participate in grid peak shaving, frequency regulation, and standby services, thereby providing

考虑储能峰谷价差套利的综合能源系统策略性经济配置

May 6, 2023 · 计及储能系统分时电价峰谷价差套利,提出了综合能源系统的供热/冷、供电策略,并以此作为经济配置模型的内层仿真优化内核。 基于全寿命周期理论和策略性仿真优化内

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · • Optimising the initial state of charge factor improves arbitrage profitability by 16 %. • The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. •

Economic benefit evaluation model of distributed energy storage system

Jan 5, 2023 · Firstly, based on the four-quadrant operation characteristics of the energy storage converter, the control methods and revenue models of distributed energy storage system to

CAN ARBITRAGE COMPENSATE FOR ENERGY LOSSES INTRODUCED BY ENERGY STORAGE

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

Optimal configuration of photovoltaic energy storage capacity for

Nov 1, 2021 · The configuration of user-side energy storage can effectively alleviate the timing mismatch between distributed photovoltaic output and load power demand, and use the

Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time,

Research on the integrated application of battery energy storage

Mar 1, 2023 · Abstract To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive

6 FAQs about [Majuro Energy Storage System Peak-Valley Arbitrage Scheme]

Is a retrofitted energy storage system profitable for Energy Arbitrage?

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage.

What is energy arbitrage?

Energy arbitrage means that ESSs charge electricity during valley hours and discharge it during peak hours, thus making profits via the peak-valley electricity tariff gap [ 14 ]. Zafirakis et al. [ 15] explored the arbitrage value of long-term ESSs in various electricity markets.

Are energy storage systems more cost-effective than batteries for Energy Arbitrage?

The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage. In the context of global decarbonisation, retrofitting existing coal-fired power plants (CFPPs) is an essential pathway to achieving sustainable transition of power systems.

Is energy arbitrage profitability a sizing and scheduling Co-Optimisation model?

It proposes a sizing and scheduling co-optimisation model to investigate the energy arbitrage profitability of such systems. The model is solved by an efficient heuristic algorithm coupled with mathematical programming.

What is the in-day optimization stage of distributed energy storage?

In the in-day optimization stage, based on the optimized output curve, taking real-time demand response into account, the real-time charge-discharge power of energy storage is adjusted dynamically with the goal of minimizing income loss, thus to realize adaptive adjustment of distributed energy storage and eliminate the risk of income loss.

Does multi-profit mode operation improve the return rate of distributed energy storage?

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic operation strategy of distributed energy storage with multi-profit mode operation.

Random Links

- Italian communication wind power base station company

- High-efficiency solar air conditioning

- Panama Xinshang Energy Storage New Energy

- Outdoor Power Supply in 2025

- Panama Colon Energy Storage Power Station Subsidy

- 5g base station power station

- Camping power station factory in Armenia

- Uruguayan portable power supply manufacturer

- China d curve circuit breaker in Kenya

- What are the energy storage container manufacturers in Buenos Aires

- Japanese brand photovoltaic panel manufacturers

- Timor-Leste Energy Storage Power Industrial Design

- Dakar outdoor communication battery cabinet custom processing factory address

- Warsaw Photovoltaic Power Generation and Energy Storage

- Wholesale 220v power station in Uganda

- Lithium battery energy storage in French data center

- Nigerian All-vanadium Redox Flow Battery

- Energy storage and new energy generation

- Koten safety breaker factory in South-Africa

- Uninterruptible power supply sales in Iran

- Maseru battery cabinet replacement

- How much does a mobile power box cost

- Santo Domingo s new solar photovoltaic panels

Residential Solar Storage & Inverter Market Growth

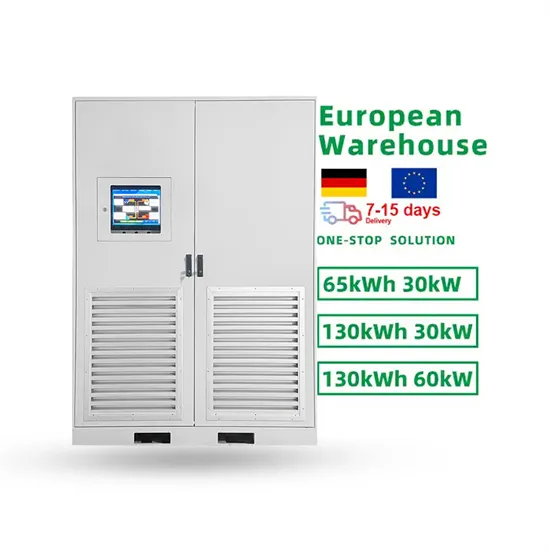

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.