Satcon to Supply PV Inverters for Czech Solar Plant Projects.

Feb 23, 2010 · Free Online Library: Satcon to Supply PV Inverters for Czech Solar Plant Projects. by "Energy Resource"; Petroleum, energy and mining Electric inverters Electric power plants

6 FAQs about [Prague PV Inverter Project]

Why is a photovoltaic system important in Czechia?

“It is very important because many people have made investments to the photovoltaic system,” Preisinger said. Stepan Chalupa, president of the Czech Renewable Energy Chamber, said that Czechia's energy market is continuously improving but better regulations are needed to prohibit fraudulent providers from operating.

How will Czechia support solar projects in 2024?

The aid will take form of direct grants which will cover up to 50% of the investment cost of supported projects. Czechia installed 967 MW of solar in 2024, driven by residential and commercial and industrial (C&I) projects, which accounted for 930 MW of the total, says the Czech Solar Association (Solární Asociace).

How much solar power does the Czech Republic have in 2022?

As the central European nation clocked in 2,627 MW of installed solar PV capacity at the end of 2022 – which is 426 MW up from the previous year, according to estimates published by the International Renewable Energy Agency (IRENA) – the Czech Republic’s continued achievement of these solar gains was on the lips of most attendees.

Is the solar industry booming in Czech Republic?

Czech Environment Minister Petr Hladik said that the solar industry is currently experiencing a huge boom. However, he dashed hopes for the country only pursuing PV by stating that its generating capacity would be a mix of renewables and nuclear. There are six commercial reactors generating roughly one-third of the landlocked country’s electricity.

Why did Czechia increase funding for C&I solar & storage projects?

Czechia has increased funding for its interest-free loan program for commercial and industrial (C&I) solar and storage projects to CZK 3 billion ($132.2 million) after strong demand exhausted the previous budget. The aid will take form of direct grants which will cover up to 50% of the investment cost of supported projects.

Will Czechia reach its solar potential?

As Czechia reaches its solar potential, with impending changes to the country’s legislative landscape ushering in greater utility-scale solar array rollouts, over 5,000 attendees – government ministers, industry experts, and key business stakeholders – descended on Prague this week for the 2023 Smart Energy Forum.

Random Links

- Record of construction of flow batteries for communication base stations

- Does the battery in the energy storage cabinet contain water

- High voltage battery home energy storage system

- China wholesale c32 circuit breaker Price

- Liberia s industrial energy storage peak-shaving and valley-filling profit model

- Photovoltaic panel installation clearance

- Czech large capacity outdoor power supply

- Energy storage battery profit rate ranking

- Promote the application of new energy storage in multiple scenarios

- 12v inverter efficiency

- How much do you know about energy storage equipment

- Small energy storage container equipment manufacturers

- Austria outdoor communication battery cabinet installation system

- Damascus Supercapacitor Company

- Compact power station factory in Cyprus

- Photovoltaic container battery protection system

- Application direction of energy storage projects

- Benin Development Site Energy Battery Cabinet Manufacturer

- Georgia photovoltaic panels

- How much does the micro inverter reduce power

- Telecom Energy Storage Clean Energy Storage Container ESS Power Base Station

- Ulaanbaatar Energy Storage Fire Fighting System

- Beirut Energy Storage Industrial Park Project

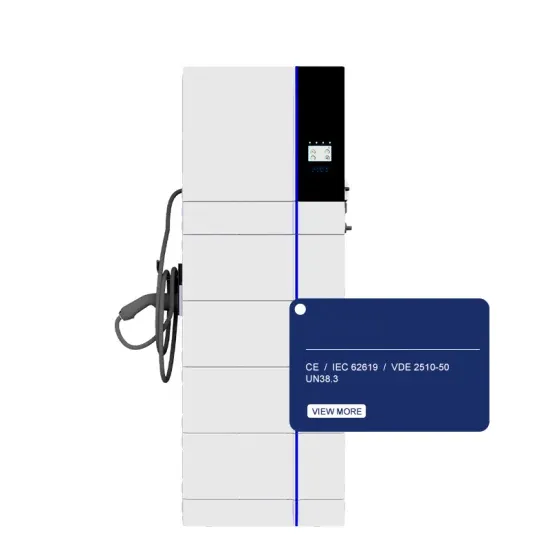

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.