Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · The choice of allocation methods has significant influence on the results. Repurposing spent batteries in communication base stations (CBSs) is a promising option to

Environmental feasibility of secondary use of electric vehicle

Jan 22, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Life cycle assessment of secondary use and physical

Apr 15, 2024 · In this paper, the retired Electric vehicles lithium-ion batteries (LIBs) was the research object, and a specific analysis of the recycling treatment and gradual use stages of

Pathway decisions for reuse and recycling of retired lithium-ion

Sep 2, 2024 · For the optimized pathway, lithium iron phosphate (LFP) batteries improve profits by 58% and reduce emissions by 18% compared to hydrometallurgical recycling without reuse.

Battery configuration dependence to power line communication

Feb 15, 2024 · To mitigate these disadvantages in BEVs, the established literature demonstrates improvements to energy storage systems, such as fast charging techniques, improved battery

Electric vehicles: Battery technologies, charging standards, AI

Oct 1, 2024 · A lithium-ion battery (Li − ion) is the most commonly used battery in an EV because of its high energy density, high power density, and long lifespan. In addition, it is

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · 摘要 Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

Life cycle assessment of electric vehicles'' lithium-ion batteries

Nov 1, 2023 · This study aims to establish a life cycle evaluation model of retired EV lithium-ion batteries and new lead-acid batteries applied in the energy storage system, compare their

Environmental feasibility of secondary use of electric vehicle lithium

Jan 22, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Joint Optimization of Transmission Bandwidth and Power for

Jan 10, 2024 · Abstract: This article investigates a wireless communication system, where multiple sensor devices powered by Li-ion batteries share transmission bandwidth and offload data to

Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · Abstract Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In the future, especially after the 5G upgrade, lithium battery companies will no longer simply focus on communication base stations, but on how the communication network

Pathway decisions for reuse and recycling of retired lithium

Sep 2, 2024 · For the optimized pathway, lithium iron phosphate (LFP) batteries improve profits by 58% and reduce emissions by 18% compared to hydrometallurgical recycling without reuse.

6 FAQs about [How to reduce the lithium-ion battery of communication base stations]

Can repurposed EV batteries be used in communication base stations?

Among the potential applications of repurposed EV LIBs, the use of these batteries in communication base stations (CBSs) isone of the most promising candidates owing to the large-scale onsite energy storage demand ( Heymans et al., 2014; Sathre et al., 2015 ).

Should repurposed lithium batteries be used as a lab system?

From the resource point of view, the MDP of repurposed LIBs isnot always preferable to that of the conventional LAB system. Recently, the environmental and social impacts of battery metals such as nickel, lithium and cobalt, have drawn much attention due to the ever-increasing demand ( Ziemann et al., 2019; Watari et al., 2020 ).

What happens if repurposed lithium ion batteries are widely promoted?

On the other hand, if the secondary use of repurposed LIBs is widely promoted,a delay in metal circulation will occur; the material availability might be questionable, and more primary lithium, copper, and aluminum have to be extracted to meet the supply shortages in the manufacturing sector.

Does secondary use of lithium ion batteries reduce the MDP value?

The findings of this study indicate a potential dilemma; more raw metals are depleted during the secondary use of LIBs in CBSs than in the LAB scenario. On the one hand, the secondary use of LIBsreduces the MDP value by extending the service life of the batteries, although more metal resources are consumed during the repurposing activities.

Are lithium-ion batteries used in EV power supply systems?

Owing to the long cycle life and high energy and power density, lithium-ion batteries (LIBs) are themost widely used technology in the power supply system of EVs ( Opitz et al. (2017); Alfaro-Algaba and Ramirez et al., 2020 ).

What is the recycling stage of a lithium ion battery?

In the recycling stage, the collectedLIB packs are dismantled to obtain the main components, such as battery cells, BMSs, and packaging, and various material fractions are recovered from these components separately (Table A1 in the supplementary materials).

Random Links

- Asuncion Sunshine Energy Storage Power Supply Supplier

- Advantages and Disadvantages of Zinc Flow Batteries

- Battery cabinet a24 average price

- Solar Onsite Energy Accessories Line

- Uruguay capacitor energy storage cabinet manufacturer

- Cost of phase change energy storage system in Douala Cameroon

- Power storage systems factory in Korea

- Moldova energy storage fire fighting equipment manufacturer

- Can I buy a 5g mini base station

- Packbatteryrotterdamholland

- China circuit breaker outdoor in Sao-Paulo

- East African communication base station lead-acid battery bidding

- Where to buy outdoor power supplies in Hamburg Germany

- China 5kw on grid inverter in China producer

- Buy high power inverter

- Seychelles Industrial Photovoltaic Panel Manufacturer

- Where is the best commercial energy storage cabinet in Warsaw

- Sudan fiber optic energy storage equipment

- Seoul BMS Battery Management System

- Eritrea 5g base station distribution cabinet

- Inverter 60v to 220v peak 5000w

- Containerized generator sales in Colombia

- How many watts does a solar street light need to be bright enough

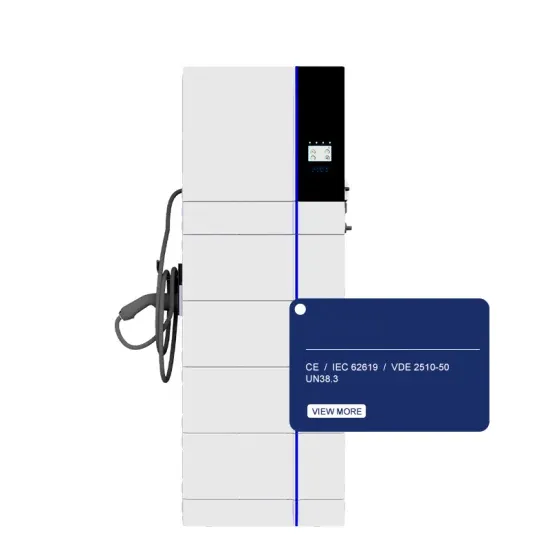

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.